Using a Predefined panel

Predefined panels on Conjointly offer a wide range of existing sample definitions, including:

- General-purpose Predefined panels, such as the USA general population and the UK general population.

- Highly specific Predefined panels, such as cat or dog owners in Australia and head of sales / marketing in the US IT industry.

- Previous panel definitions that were drawn from your company’s past experiments.

Choosing a Predefined panel

When you select the Use a Predefined panel option, search for the panel that matches your requirements. You can review the panel’s average cost, speed, screening questions, and more. After selecting a panel and entering your required number of responses, the system will provide an estimated cost and data collection time.

If you have specific sample requirements that are not listed in the existing Predefined panels, please send us a request.

Common definitions used in a Predefined panel

Below are some common definitions you will likely see in the list of Predefined panels:

- Users - Current users of the product being tested.

- Non-users - Respondents who are currently not a user of the product being tested.

- Considerers - Current non-users who would at least consider purchasing the product being tested.

- Non-rejectors - Current non-users who are not considerers but still may purchase the product.

- Rejectors - Current non-users who would not consider purchasing the product/brand being tested.

- P12M - Respondents who were users of the product in the past 12 months (duration can be modified to past 3 months (P3M), past one year (P1Y), etc.).

- N12M - Respondents who are likely to purchase a product in the next 12 months (duration can be modified to next 3 months (N3M), next 2 years (N2Y), etc.).

For example, screening questions for consumers of instant noodles can be:

Which of the following ready-to-eat meals do you usually purchase for your personal use? Please select all that apply.

- Macaroni and cheese

- Instant noodles (Users if selected)

- Soup

- Mashed potatoes

- Lasagna

[shown to Non-users] Would you consider buying instant noodles for your household?

- Definitely would consider (Considerers)

- Probably would consider (Considerers)

- Maybe (Non-rejectors)

- Probably would not consider (Rejectors)

- Definitely would not consider (Rejectors)

By default, we recommend including both users and non-rejectors in the survey to obtain comprehensive insights that may aid in identifying new conversions. In addition, including only users may introduce bias into the results as users have already bought into the benefits of the product.

How Conjointly sources respondents for your surveys

With an extensive global network of sample providers, Conjointly grants you access to over 100 million panellists in 150 countries, ranging from the general population to deeply profiled audiences. If you have additional requirements for your panel, feel free to reach out the support team.

The Conjointly fieldwork team works diligently with global panel networks to deliver quality respondents straight into your survey through the following process:

- Respondents sign up to one of our panel networks, who asks them an extensive list of profiling questions, including but not limited to demographics, shopping / spending habits, and the nature of the household.

- We determine feasibility and cost by analysing respondent profiles to achieve time and cost efficiencies. For example, if you need 100 iPhone users, we will send 100 survey invitations to people who have already identified themselves as iPhone users instead of inviting a larger generic sample size (e.g. 200 adults) in the hope of meeting the criteria. Furthermore, the more profiling we do, the more cost-effective the sample becomes, resulting in more accurate feasibility estimates.

- Once you launch an experiment with a Predefined panel, we inform our panel providers to start inviting respondents from their panels to our survey link, using profiling where possible. Aside from receiving a survey link via email from the supplier, respondents may also find surveys on websites/apps the supplier operates.

- Respondents access the experiment through the survey link, which directs them to our screening questions. Respondents who do not meet the survey criteria (e.g. an Android phone user) are redirected back to the supplier. Qualifying respondents are redirected to Conjointly to complete your experiment. If our system detects that they are providing low-quality responses, they will be redirected to the supplier and identified as a “low-quality response”.

- Respondents are redirected to the supplier upon survey completion to claim their incentive. Subsequently, we may review the actual observed cost and feasibility of the Predefined panel and make price or sample size adjustments as necessary.

How panel costs are calculated

Panel costs are calculated per respondent and vary based on country, age, and other characteristics. The Conjointly platform quotes costs in real time as you complete the panel selection process. Once you launch your experiment, we will confirm the feasibility and immediately start data collection, which is normally completed in less than two days.

How respondents are compensated

Our panel networks manage and provide incentives for the panellists, which may include monetary payouts, coupons, points, vouchers, charity donations, and lottery draws. Respondent participation is voluntary, and recruitment involves a double opt-in procedure and confirmation of personal information. We monitor the quality of managed sample, and you will only pay for complete, quality responses.

How to track your fieldwork progress

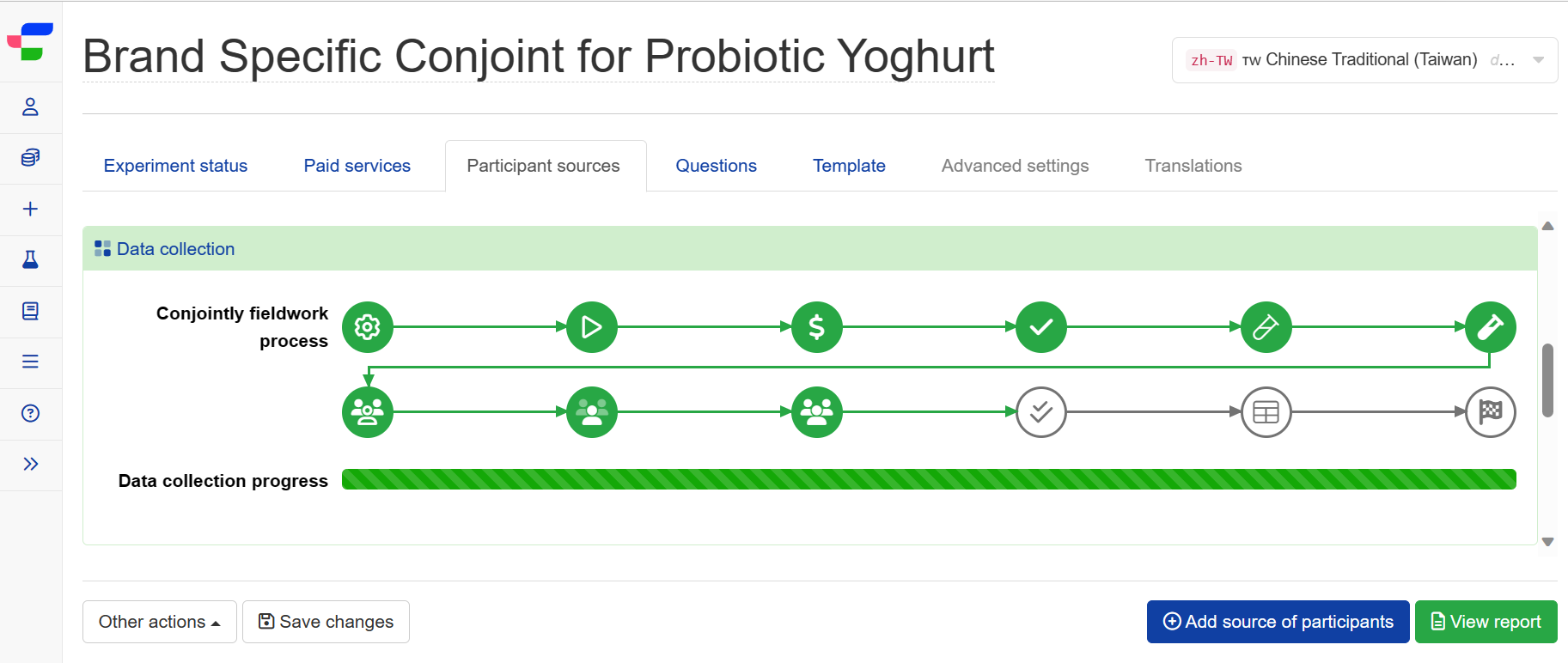

When you select a Predefined panel, Conjointly fully manages the fieldwork process. You can monitor the fieldwork progress through the visual workflow displayed under the Participant sources tab, where completed steps appear in green.

Here’s what happens at each stage of the fieldwork process:

| Icon | Step name | Description |

|---|---|---|

| Setup | The panel source is being configured according to your specified respondent criteria and quotas. | |

| Data collection launched | Your study is being prepared and awaiting payment confirmation before collecting responses. | |

| Paid | Payment for your respondents has been received, and data collection is beginning. | |

| Pre-launch testing | The Conjointly team is conducting pre-launch testing to verify survey logic, display, and redirects. | |

| Soft launch | A small initial sample (50-100 respondents) is being invited to verify feasibility and data quality. | |

| Soft launch checked | The Conjointly team is reviewing the initial responses collected during soft launch for quality and consistency. | |

| Fully launched | The remaining respondent sample is being invited and data is actively being collected. | |

| Quotas not closed yet | Most data is collected, but remaining demographic or profile quotas are being filled. | |

| Pending checks | The required number of responses has been reached and data is now pending quality checks. | |

| Checked | Final quality checks are being conducted, with poor-quality responses being removed and replaced. | |

| Uploading variables | Profiling data are being uploaded as external variables. | |

| Complete | Your fieldwork is complete, and your report is ready. |

By default, our team will proceed from one step to the next, to ensure prompt delivery of sample. However, you have the option to request pausing data collection after any of these steps if you want to review partial sample yourself. Please ask our support team for this, preferably before you order data collection.

At the end of the process, we welcome your feedback on the sample and your experience via this feedback form.

Standard procedure for different quota types

Conjointly follows these standard procedures for managing different quota types to ensure your Predefined panel aligns with your research objectives and project requirements.

Hard quotas

- Hard quotas are implemented within a 5% margin of error.

- For example, if we commit to 100 male as a hard quota, we will deliver between 95-105 male respondents.

Soft quotas

- Soft quotas are implemented with a 20% margin of error. Once this margin is reached, we will prioritise speed if the deadline is approaching to ensure timely completion of your research.

- For example, if we commit to 100 males as a soft quota, we will do our best to deliver 100 male respondents. However, in the event that the deadline is approaching in 1-2 days:

- If we have 80+ males (20% of the soft quota), we will re-open any female screen-outs to reach the full target sample.

- If we have less than 80 males, we will reach out to you to discuss either relaxing the male quota or continuing to fill quotas with possible delays.

Natural fall quotas

- Natural fall quotas are implemented by including a question in the survey to capture the relevant options and monitoring the natural distribution.

- For example, when we commit to a natural fall quota for ethnicity, we will have to add and monitor the Ethnicity question.

- If we find that an ethnicity group (e.g. Hispanic) is significantly lower than the expected rate or census data (e.g. getting 1/100 responses while the census representation for Hispanic is 10%),

- We will try to boost through profiled groups or other means that do not affect the overall speed or incur too high of an additional cost to us.

- If boosting proves challenging, we will contact you to discuss whether the skew would affect your study and potentially recommend a booster panel to ensure good distribution.

- If an ethnicity group is only slightly lower than expected (e.g. getting 5/100 responses while the census representation is 10%), we will continue monitoring without alerting you or making changes to our sampling plan.

- If we find that an ethnicity group (e.g. Hispanic) is significantly lower than the expected rate or census data (e.g. getting 1/100 responses while the census representation for Hispanic is 10%),

FAQs

What do I need to consider before launching a panel?

When launching your survey using a Predefined panel, we recommend considering the following points:

- We will oversee all screening logic, quotas, survey redirects, and low-quality termination criteria. You can get in touch with us to ensure that your criteria are taken into account through your panel, rather than your experiment.

- We do not support external links when launching through a panel. For example, asking respondents to click on an external link to check out your product’s web page during the survey, is not supported.

- Once data collection is complete, our team will upload the screening question results, which means you do not have to repeat screening questions in your survey so that respondents don’t have to answer the same question twice.

What extra data is included with Predefined panels?

Are screening questionnaires in the native language of the panel?

Yes! When you ask us to provide a panel for a particular country, we will ensure that the screening questionnaire is translated into the official language of that country, and ascertain that participants possess the ability to comprehend and effectively respond to the questions.

This means that when you launch a survey in Germany, the screener questions will be in German, and we will recruit only German speakers.

Why do I have unrelated questions in my Predefined panel?

There are two reasons why seemingly unrelated questions (prescription to medical marijuana, windsurfing, income, etc.) may appear in your Predefined panel:

- Preventing positive bias.

Conjointly includes certain questions to prevent respondents from trying to qualify for any survey through positive / acquiescence bias (tendency to say "yes" to questions). If the main qualifying question is a yes/no question (e.g. "Are you studying to be a nurse?"), respondents may say "yes" simply to qualify for that study. We will sometimes add other yes/no qualifying questions (e.g. "Are you a windsurfer?", "Do you have a prescription for medical marijuana?") and screen out those who say yes to too many of them (where it is unlikely that they are a wind-surfing nursing student who uses medical marijuana). - Standard profiling questions.

We include some questions as standard profiling questions that you can use as segmentation variables. These are especially relevant for product and pricing surveys. A common profiling question is asking respondents to identify which income band they fall into.

How quickly can you get results for a general population survey in the US with less than 10 questions?

For a 200–500 respondents gen pop (general population) study, data collection should take 1-2 days. Please see the US gen pop Predefined panel for more details.

Each Predefined panel shows the average number of responses that can be collected per day and the estimated data collection time, which is different depending on the specificity of the sample.