Have you ever wondered what respondents go through to answer your surveys? This article explores the five stages of the respondent journey and the motivations behind survey participation.

Reliable research starts with real human respondents. But have you ever wondered what respondents go through to answer your surveys? Understanding this journey is not just about empathy—it’s about adopting a participant-first mindset to foster a healthy survey ecosystem that maximise response rates and quality. This article delves into the five stages of the respondent journey and explores key motivations behind survey participation.

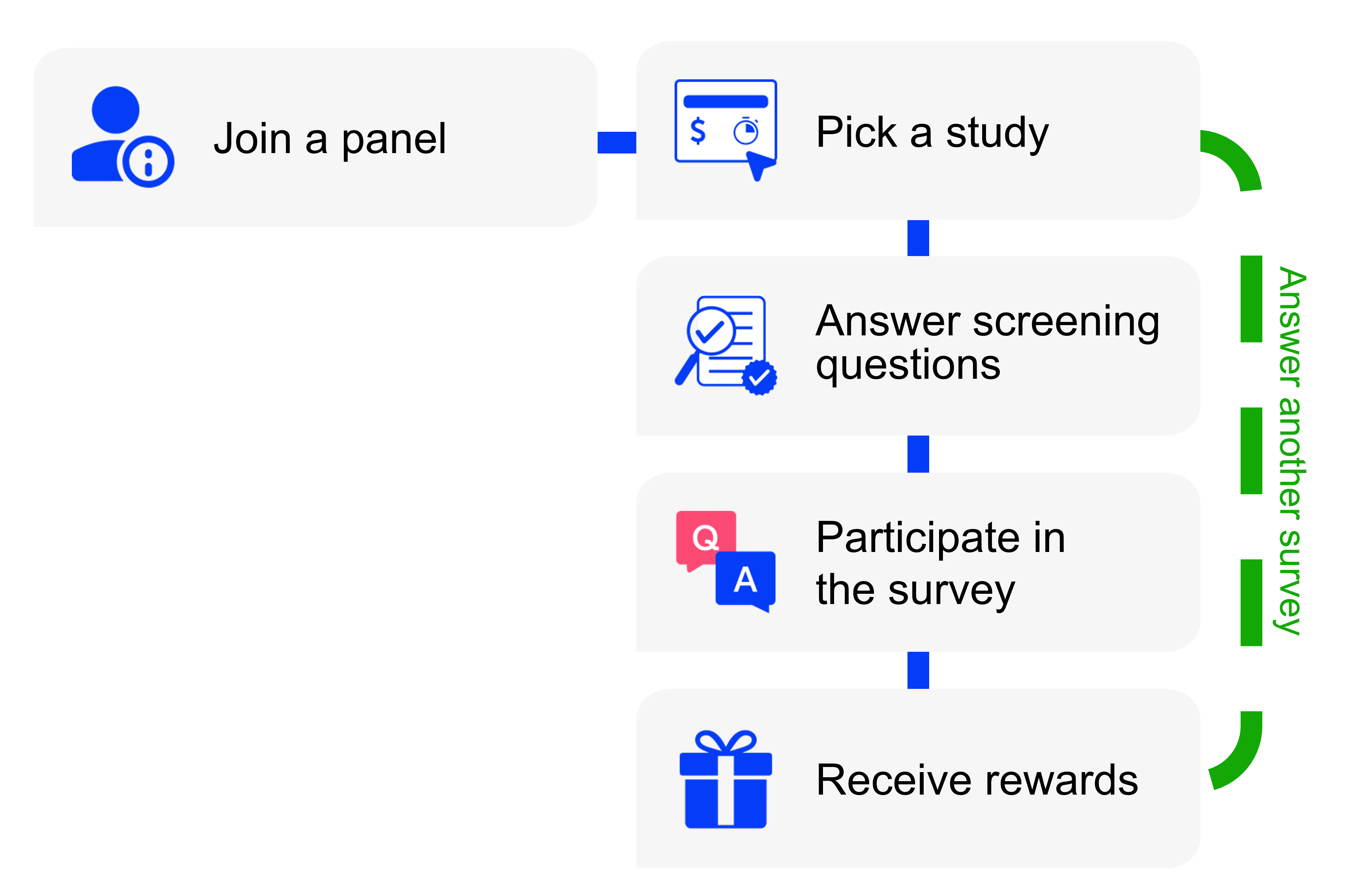

The five stages of the respondent journey

1. Join a panel

Most respondents are recruited via survey communities or websites, where they sign up and create detailed profiles acting as a ‘survey resume’. These profiles include personal details, household composition, job information, shopping habits, and other relevant data. The more complete and accurate the profile, the better chance a respondent has of being matched with relevant surveys.

There are various channels respondents can access these survey sites, including:

- Search engines: Many discover survey opportunities through active online searches for ways to earn extra income or share opinions.

- Online advertisements: Targeted digital ads often lead potential respondents to survey sites.

- Loyalty program connections: Some survey communities are extensions of existing supermarket or airline loyalty programs, allowing members to earn additional rewards.

- Professional networks: For specialised groups, such as medical professionals, invitations to join research panels often come through industry-specific online communities.

- Participation in a study: Some communities practice a reverse approach. They first recruit respondents for a study and upon completion offer them the opportunity to join the community.

If you’re curious about the respondent experience, you can join consumer survey communities like Triaba, or check out SurveyPolice for listing and rankings of various consumer survey sites. Looking to participate in B2B research? Explore sites like Respondent and User Interviews, which offer opportunities beyond surveys, including in-depth interviews and group discussions.

2. Pick a study

Once part of a panel, respondents typically encounter survey opportunities in two ways: a menu of options to browse or tailored invitations based on their profiles. Some communities provide detailed previews including topic, estimated time, and reward, while others withhold this information to avoid suggesting what profile is needed.

Attractive studies – those offering higher rewards for less effort – tend to fill up quickly, so keen respondents often need to act fast. So next time when you find your data collection is stalling, consider boosting your survey incentives to attract more participants and speed up your research process.

3. Answer screening questions

Before participating in a survey, respondents must answer screening questions to determine if they meet the study criteria. These questions serve multiple purposes:

- Demographic and characteristic filtering: Ensures respondents match the target audience and possess specific traits or experiences relevant to the study.

- Quota management: Helps balance sample composition to ensure overall representativeness.

- Quality control: Includes seemingly unrelated queries to flag respondents who might agree to everything just to qualify.

- Segmentation in reporting: Allows for detailed analysis of subgroups within the overall sample.

Effective screening not only ensures the right participants are included, but also helps identify potential fraudulent responses. However, researchers should balance thoroughness with respondent experience, as overly lengthy or intrusive screeners can lead to drop-offs and frustration.

4. Complete a survey

Well-designed, relevant surveys tend to be more enjoyable for participants, increasing the likelihood of insightful responses.

Aim for an appropriate survey length that balances depth of information with respondent fatigue, and ensure your survey is participant-friendly. Keep questions easy to understand and present them in engaging ways, using visuals, interactive elements, or varied question types.

By focusing on these aspects, you can boost completion rates, improve data quality, and create a positive experience for respondents, potentially increasing their willingness to participate in future studies.

5. Receive rewards

Upon completion, respondents receive confirmation and rewards. Most panels use an internal currency that can be cashed out or converted to product samples, loyalty points, or even charitable donations.

Reward rates typically vary based on how niche the respondents are. Consumer survey sites may offer anywhere from a few cents to several dollars worth of rewards per survey. B2B and qualitative panels typically pay more. Healthcare communities often offer the highest compensation, with doctors potentially receiving several hundred dollars for a single survey.

While rewards are part of the cost of panel responses, they are not always the largest expense. Panel providers often face considerable outlays for continuous respondent recruitment due to high turnover rates. This ongoing need to replenish and expand the respondent pool contributes substantially to the overall cost of maintaining a quality panel.

For an estimate of total costs, you can check out the cost per completed response in pre-defined panels in your account.

Notably, some survey communities do not offer rewards at all because rewards are not the only reason why people participate in market research.

Why do people complete surveys? Insights from Australian respondents

To understand the motivations behind survey participation, we conducted a study where a hundred Australian survey participants shared their reasons for completing surveys via video responses.

The following video features a selection of insightful comments (published here with permission), offering a glimpse into the diverse reasons people participate in surveys.

Taking into account all responses, the most common motivations for completing surveys were:

- Earn extra income: Many respondents view surveys as a way to earn extra income or rewards, which helps with everyday expenses like groceries and fuel.

- Contribute to change: Participants derive satisfaction from knowing they’re helping companies and organisations improve their offerings through their opinions on products, services, and societal issues.

- Fill time and get distracted: Some respondents, particularly those with flexible schedules like retirees or students, engage in surveys as an interesting and fulfilling pastime.

- Learn something new: Participants also recognise surveys as a source of information about new products and trends, keeping them informed of current issues.

These diverse motivations suggest that by offering fair rewards and designing engaging, meaningful surveys, we create a win-win scenario where respondents feel valued while businesses gain actionable insights.