In November 2023, Conjointly conducted a survey on over 400 New Zealanders, to understand their opinions on a variety of topics, from their economic outlook, to travel, and more.

In November 2023, Conjointly surveyed over 400 respondents, representative of the New Zealand general adult population. The goal of the survey was to explore consumer attitudes on three main topics:

- Consumer sentiment on the rebranding of Countdown to Woolworths.

- Concerns about economics and the cost of living.

- Attitudes toward holiday travel.

Consumer sentiment on the rebranding of Countdown to Woolworths

Countdown is more liked than Woolworths by respondents

Respondents view Countdown’s branding as more likable than Woolworths, with 61% of respondents finding Countdown’s branding likeable, compared to 54% for Woolworths.

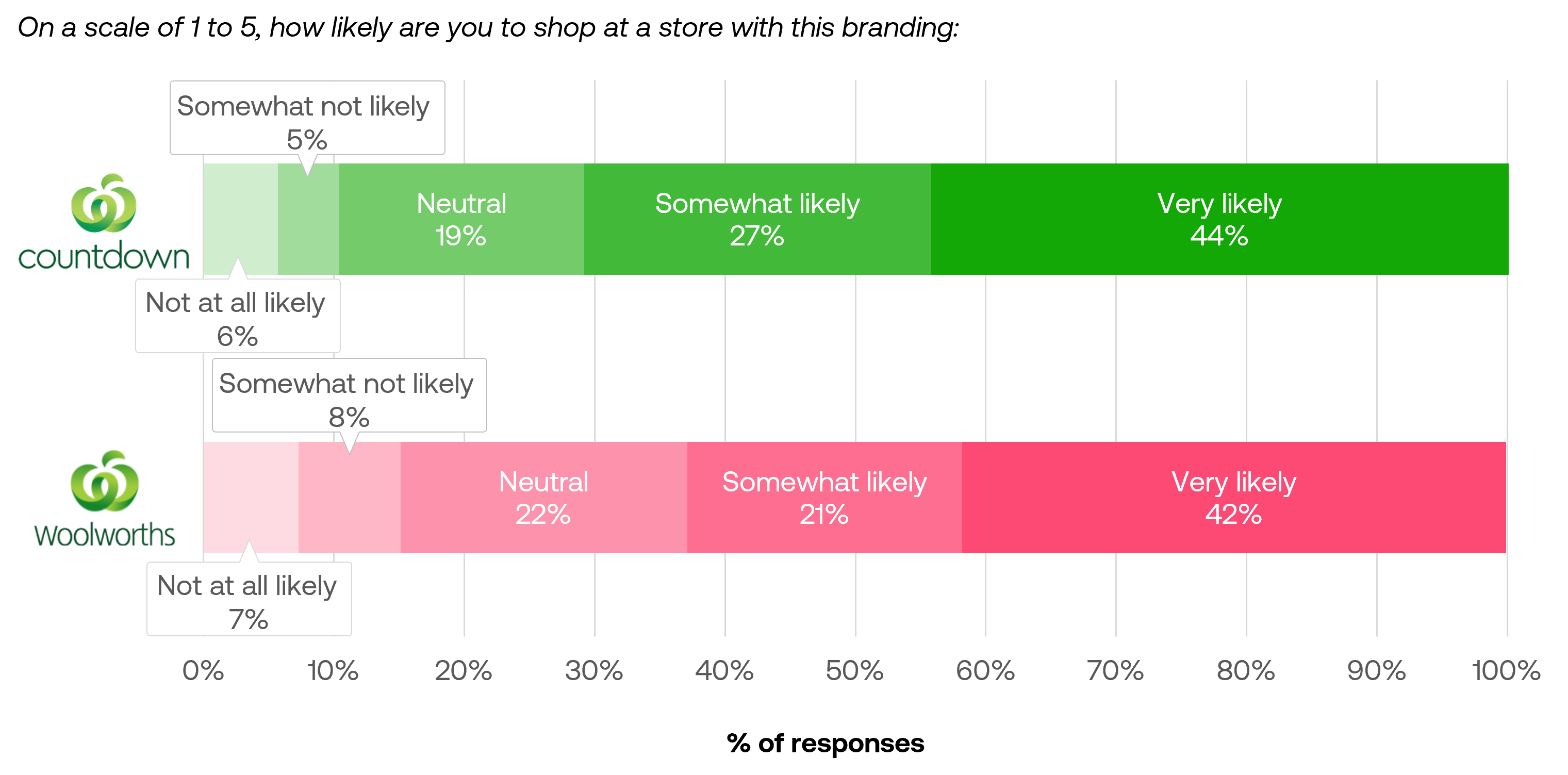

Countdown tops Woolworths in consumer shopping preferences

Furthermore, 71% of respondents expressed a likelihood to shop at a store with Countdown branding, slightly surpassing the 63% of consumers who said they would be likely to shop at a store with Woolworths branding.

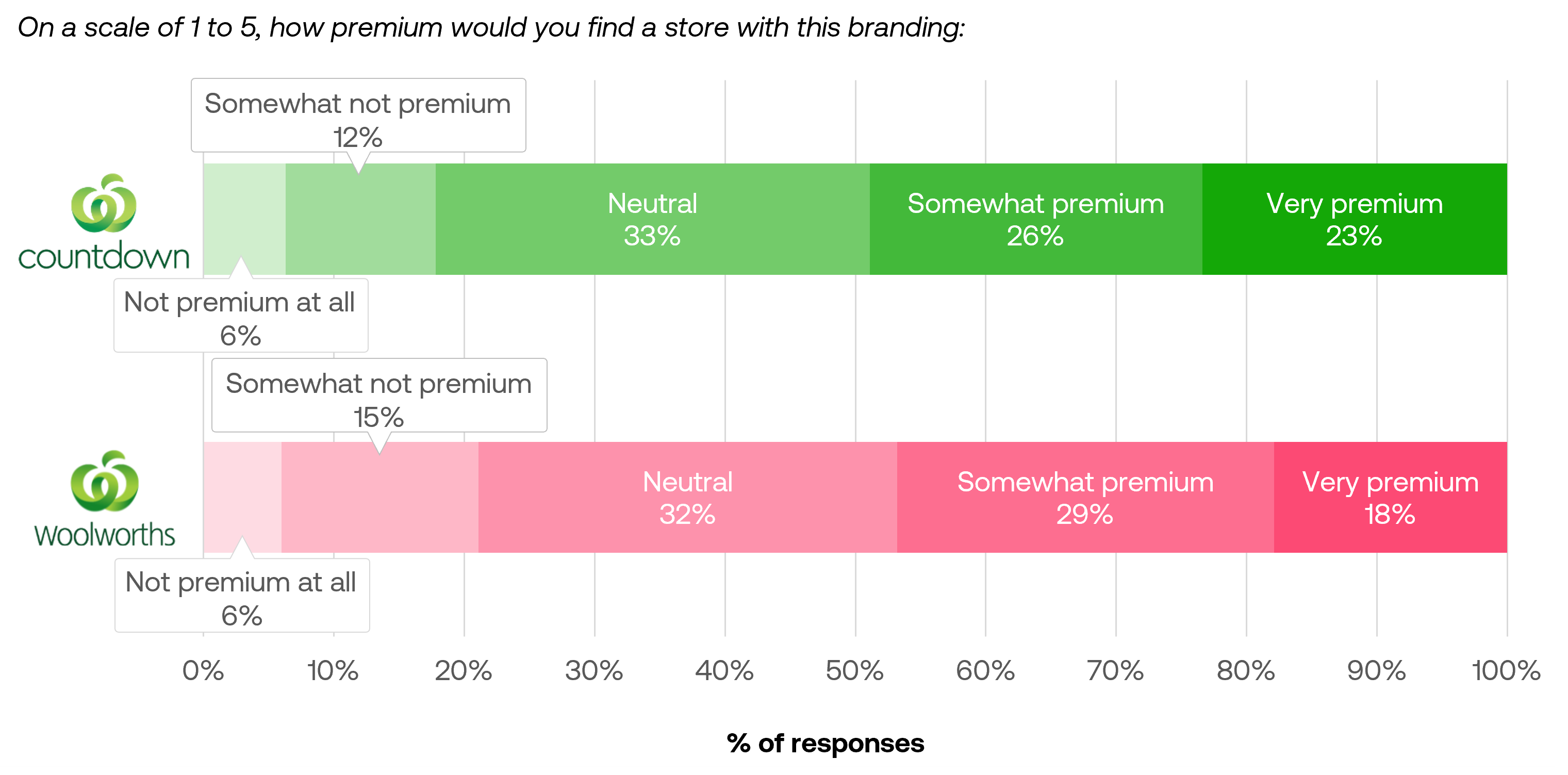

Countdown is perceived as slightly more premium than Woolworths

When asked about how premium respondents perceive each brand, Countdown narrowly outperformed Woolworths, with 49% to 46%.

Economic and Cost of Living Concerns

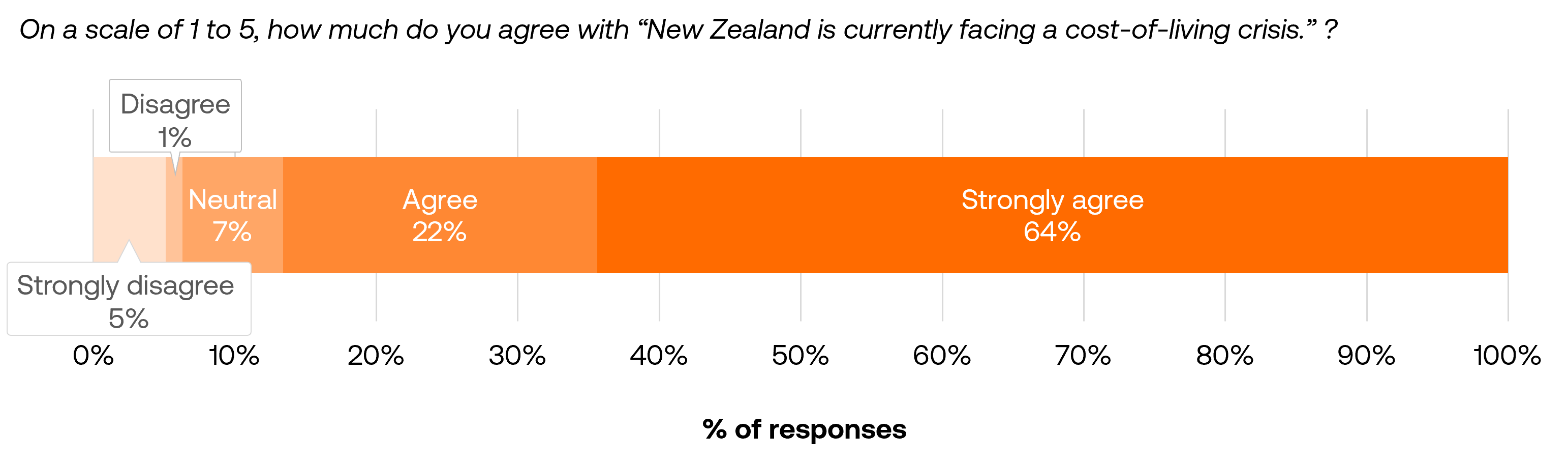

8 out of 10 respondents agree they are in a cost-of-living crisis

86% of respondents agree that New Zealand is experiencing a cost-of-living crisis, while 64% strongly agree with the statement, and only 6% disagree.

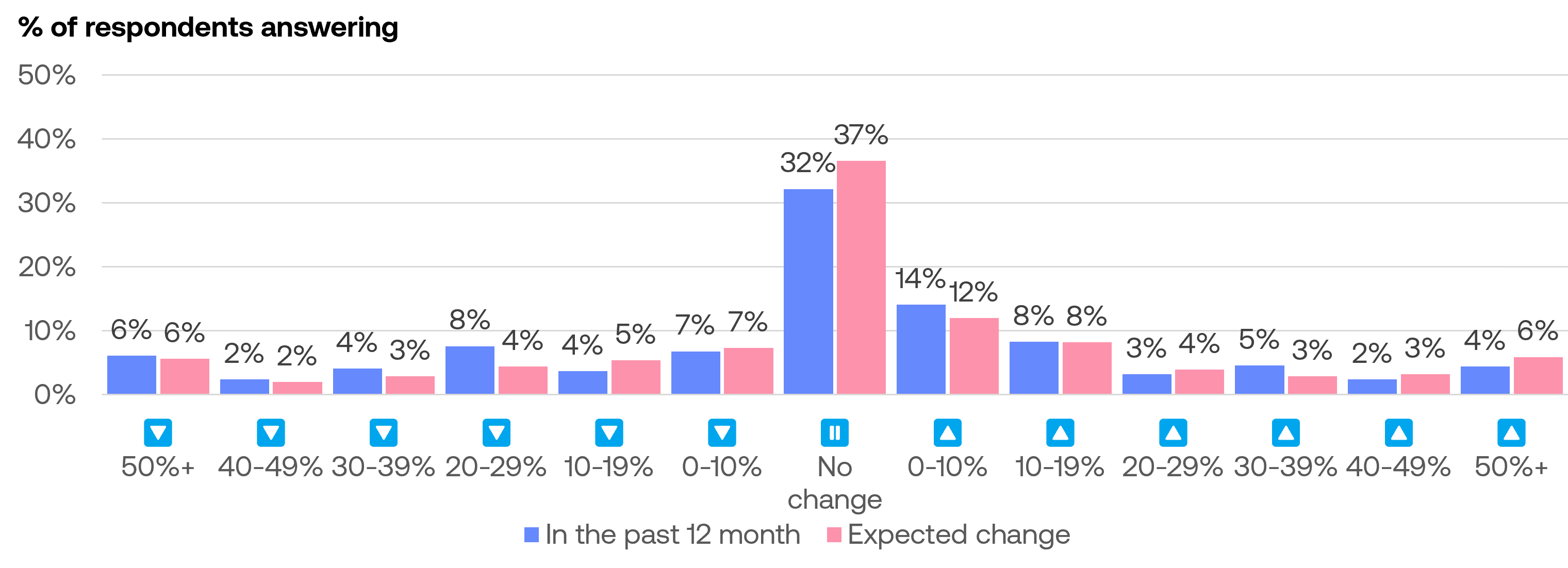

The majority of consumers expect household income to remain stagnant or decrease

69% of consumers surveyed have experienced either no change or a reduction in their household income in the past 12 months. In addition, 72% of respondents anticipate that their household income will either stay the same or decrease in the near future, echoing their concerns about the rising cost of living.

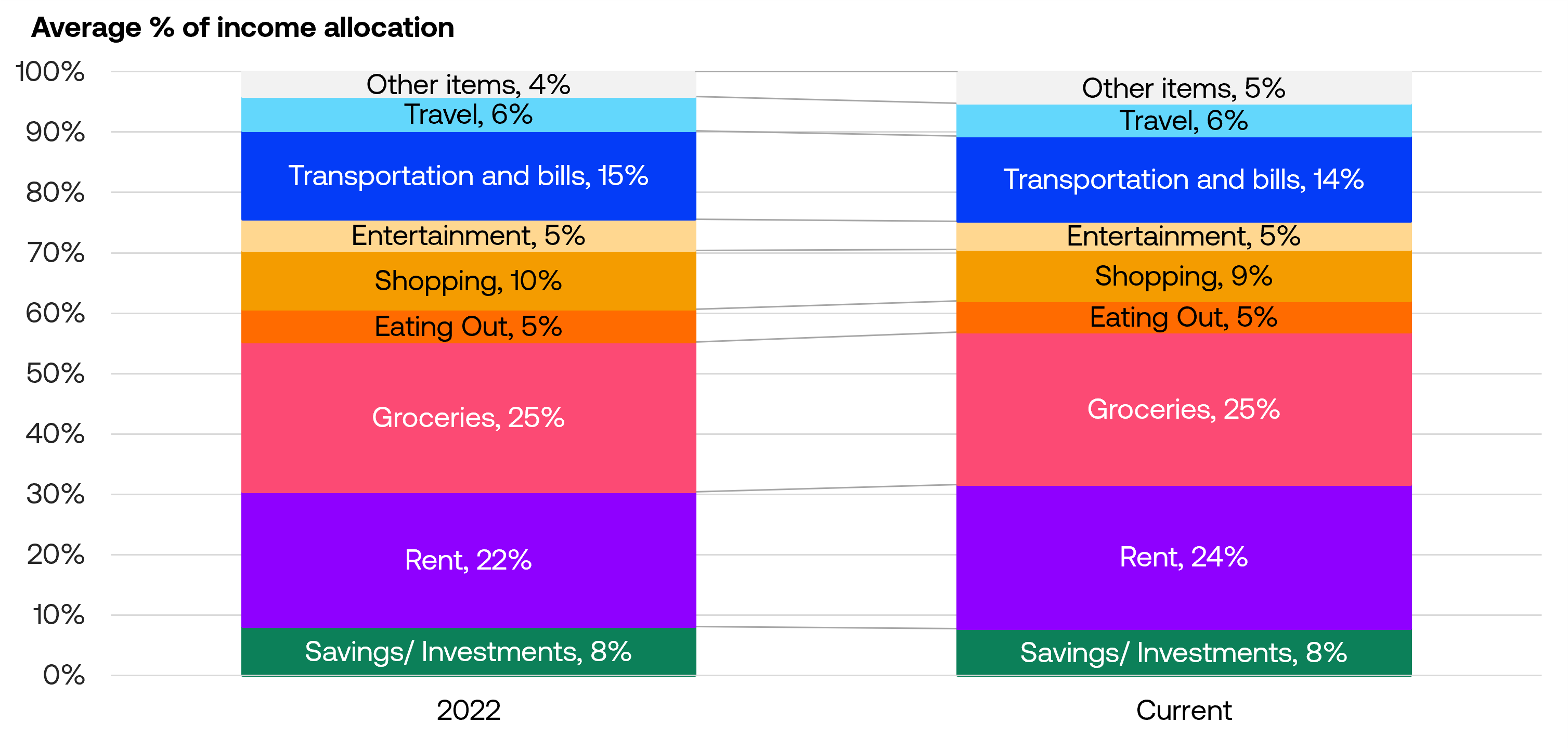

Consumers are spending more on rent than in 2022

Compared to 2022, consumers report spending more on rent, shifting allocations from other components. Notably, rent and groceries now comprise half of the respondents’ income allocation.

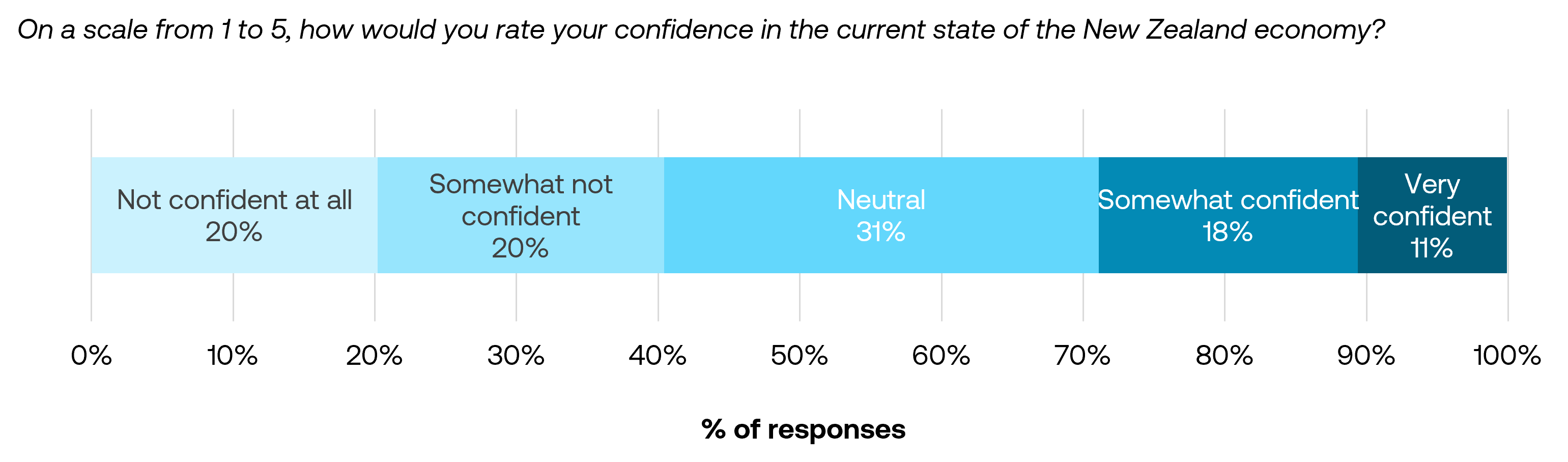

4 out of 10 consumers are not confident in the New Zealand Economy

When asked to rate their confidence in the current state of the New Zealand economy, 40% of consumers reported being not confident. However, 29% reported being either somewhat confident, or very confident.

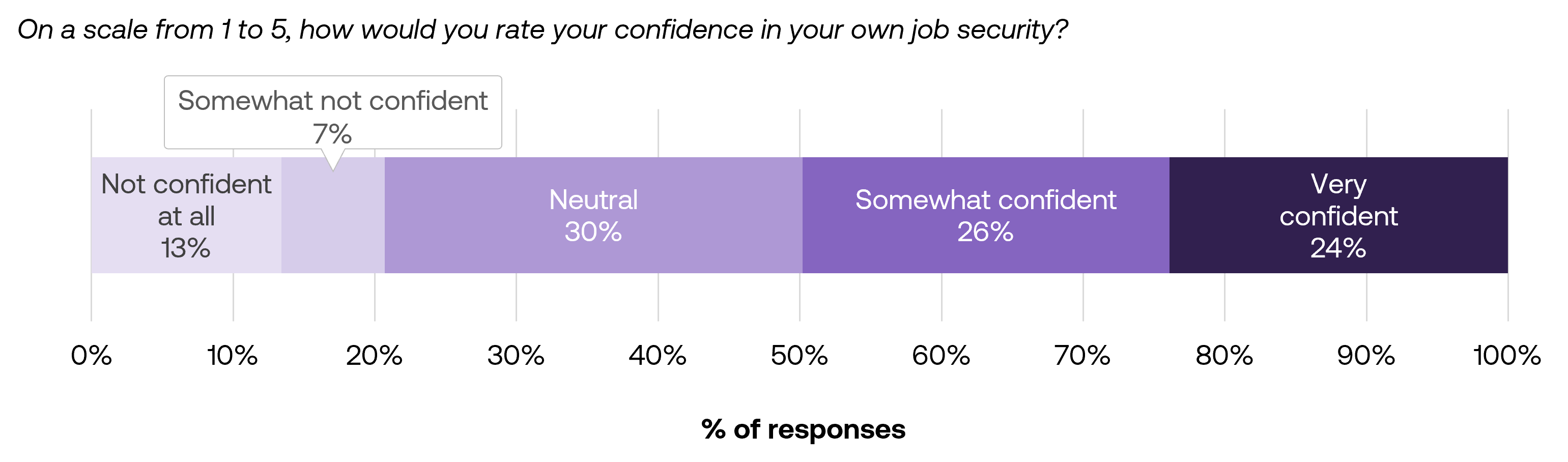

Over half of respondents remain confident in their job security

Over 50% of consumers report being confident in their job security, with only 20% reporting being not confident.

Overseas travel

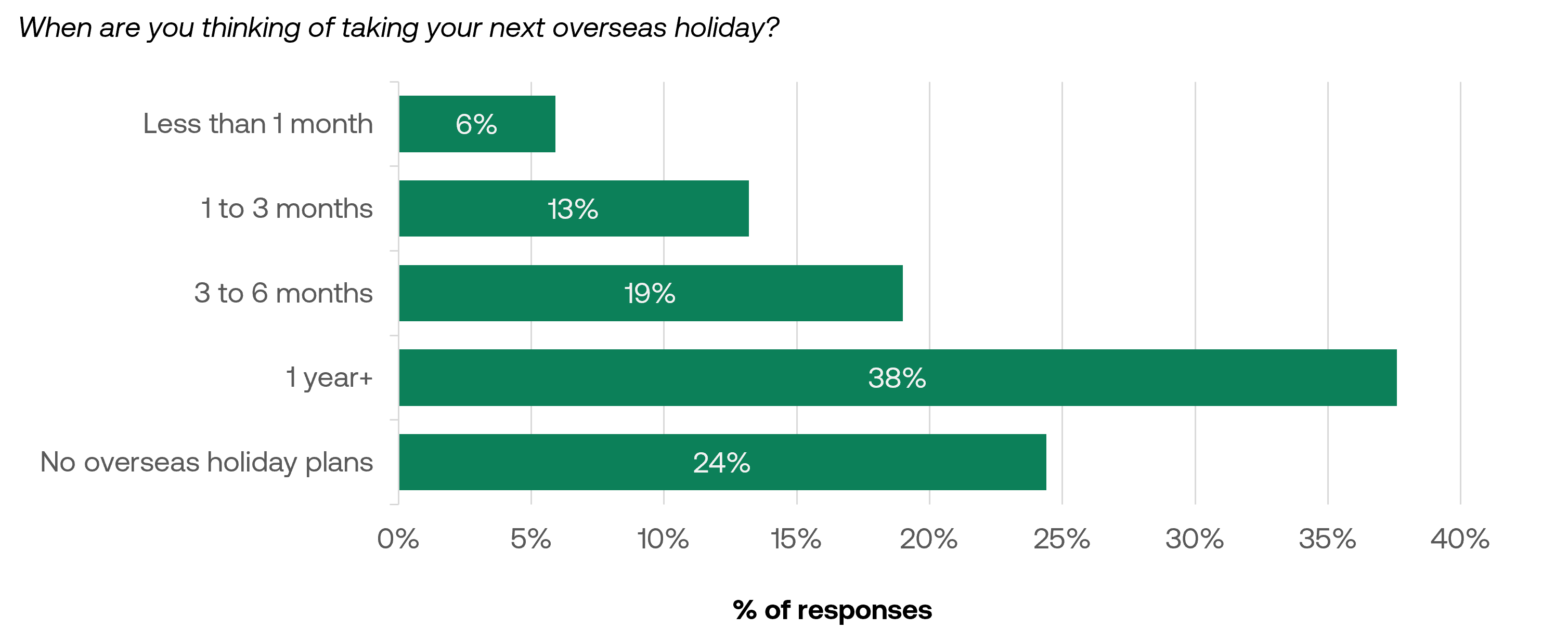

Less than half of consumers plan to take an overseas holiday within the next 6 months

The majority of respondents do not have plans to take an overseas holiday within the next six months, with nearly a quarter having no overseas holiday plans in the foreseeable future.

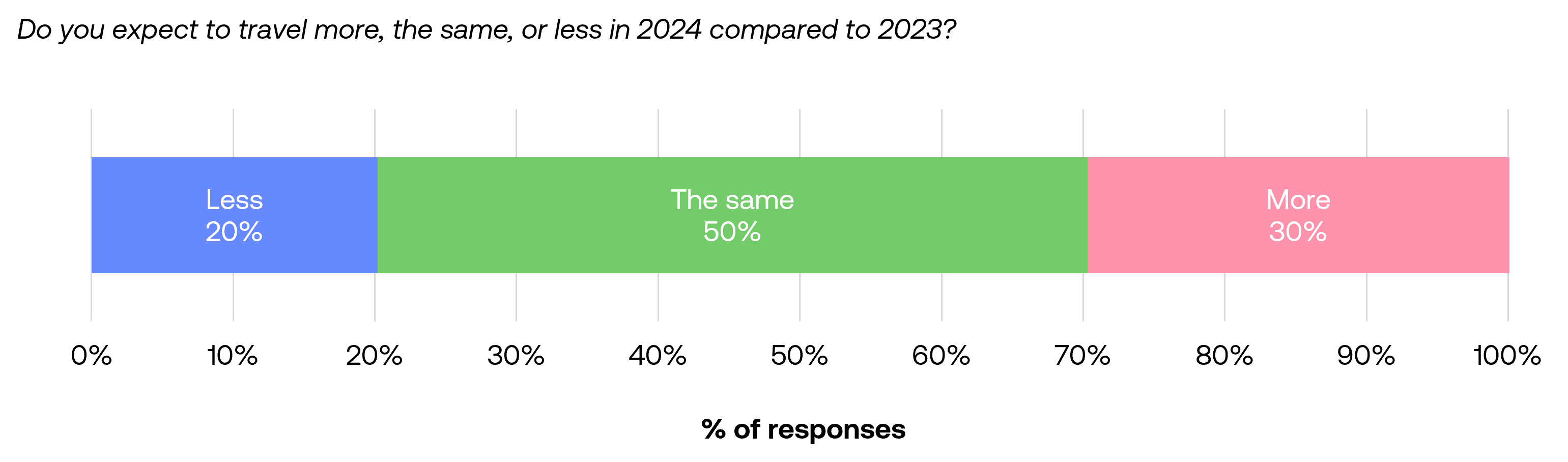

Over two-thirds of respondents expect to travel as much as or less in 2024 than they did in 2023

50% of New Zealanders expect to travel the same amount in 2024 compared to 2023. 30% expect to travel more, while 20% expect to travel less.