Conjointly surveyed 308 US consumers to understand which meal replacement product features excite them, which they perceive as must-haves, and which leave them indifferent.

The meal replacement drink market continues to evolve as consumers seek convenient yet nutritious alternatives to traditional meals. With brands competing to differentiate through innovative features and formulations, understanding which product attributes truly excite consumers has become essential for gaining market share in this competitive landscape.

A segment of the new generation of consumers, influenced by social media, approaches the purchase of lifestyle products not on impulse or habit, but through meticulous comparison similar to professionals evaluating B2B solutions. This trend is particularly evident within functional foods, such as the rapidly growing meal replacement category. In a March 2025 study among UK consumers, we noted a shift in consumer behaviour. Most shoppers now dedicate more time to researching nutritional and functional benefits before making purchases compared to five years ago. This trend is particularly pronounced among younger consumers, as over 70% of those under 35 report increased research time when evaluating products compared to five years ago.

This “hyper-optimising” consumer mindset requires research methods that can match their sophistication. That’s why, to provide these insights, Conjointly surveyed 308 US consumers who have used or considered meal replacement drink products from 18 March to 14 April 2025. The research explored consumption frequency, brand awareness and usage, and applied the Kano Model methodology to categorise product features based on how users feel if the attribute is included or excluded. Results were then weighted to align with US population distributions across age and gender demographics.

Consumption pattern

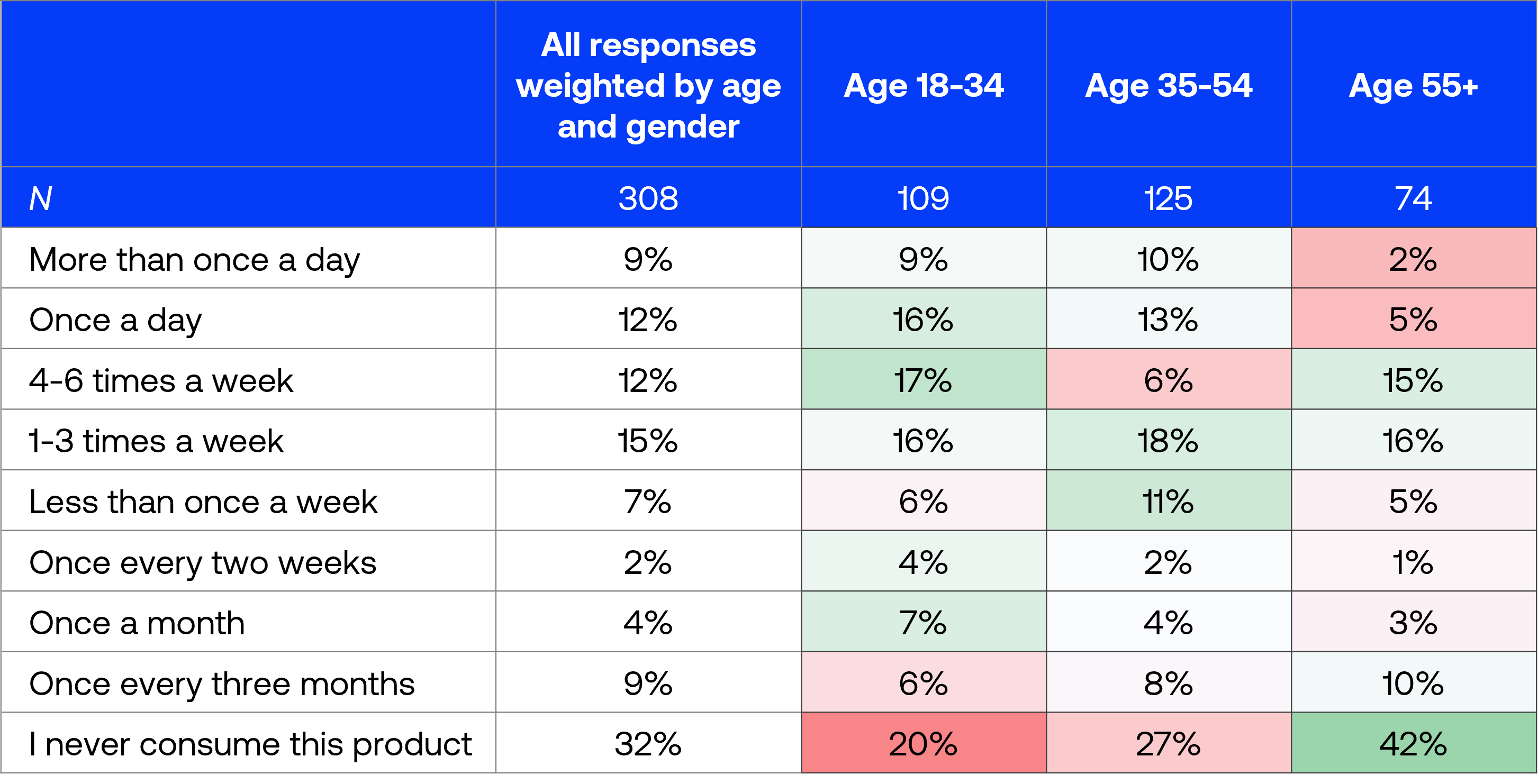

Examining how frequently respondents consume meal replacement drinks revealed clear age-based patterns. Younger consumers (18-34 years old) demonstrated higher daily consumption rates, with 25% consuming these products at least once daily compared to 23% of the 35-54 age group and only 7% of those aged 55+.

The 18-34 demographic also showed regular usage patterns, with 17% consuming meal replacements 4-6 times weekly, suggesting this group incorporates these products into their routine more consistently than other age segments.

Meanwhile, the 35-54 age group reported the highest moderate usage, with 18% consuming meal replacement products 1-3 times per week, suggesting they viewed meal replacements as occasional solutions rather than daily nutrition.

Notably, 42% of those 55+ never consumed meal replacement products, highlighting a significant market opportunity gap among older consumers.

Brand awareness and recent usage

To understand the current competitive landscape and determine which brands command the most market awareness and usage, we asked respondents two questions regarding 10 of the most popular meal replacement brands in the US:

- Which of the following meal replacement brands are you aware of?

- Which of the following meal replacement brands have you consumed in the past three months?

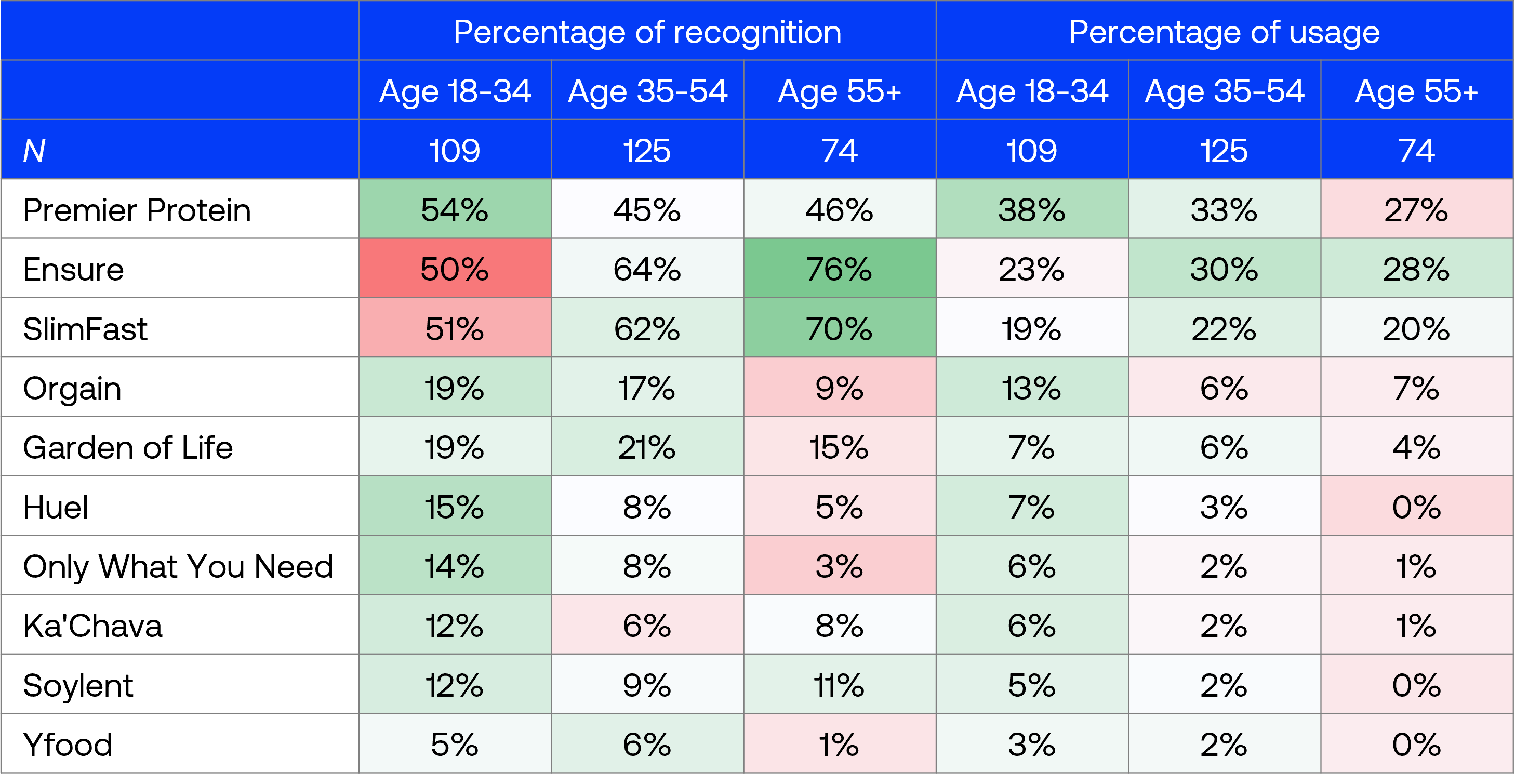

Ensure (63% recognition) and SlimFast (59% recognition) dominated brand recognition, with Premier Protein in third position (45% recognition).

However, Premier Protein achieved the highest usage rate of 30%, demonstrating the highest conversion efficiency at 67%. This outperformed Ensure’s 38% conversion rate (24% usage from 63% recognition) and SlimFast’s 32% conversion rate (19% usage from 59% recognition).

The middle tier of brands showed modest recognition but low usage rates. Garden of Life (17% recognition, 5% usage) and Orgain (14% recognition, 8% usage) had established some market presence but appear to struggle to convert awareness into regular consumption.

Other brands including Huel, Soylent, Ka’Chava, and OWYN all showed single-digit awareness and minimal usage rates under 3%.

Our age-segmented analysis revealed that younger consumers (18-34) show notably stronger recognition (54%) and usage (38%) of Premier Protein compared to older demographics.

In contrast, established brands like Ensure and SlimFast demonstrated stronger recognition among older demographics. Ensure achieved its highest recognition among those 55+ (76%), substantially outperforming its awareness among younger consumers (50% for ages 18-34). Similarly, SlimFast showed stronger recognition among the 55+ (70%) and 35-54 (62%) segments compared to younger consumers (51%).

Notably, emerging brands including Huel, Soylent, and Yfood registered 0% usage among the 55+ demographic despite varying levels of recognition.

These findings highlighted how brands might need different strategies to grow, e.g. established brands should focus on appealing to younger consumers, while newer brands need to build both recognition and trial among older demographics.

Feature classification using the Kano model

The survey included the Kano model methodology to analyse how the 221 actual meal replacement drink consumers respond to the presence or absence of certain features.

The Kano model helped categorise these meal replacement features into one of the following categories:

- Attractive features: Unexpected features that delight customers when present but don’t cause dissatisfaction when absent

- Must-have features: Expected features that cause dissatisfaction when absent but don’t increase satisfaction when present

- Performance features: Features that create proportional satisfaction when present, higher performance yields higher satisfaction and vice versa

- Indifferent features: Features that neither impact satisfaction nor dissatisfaction regardless of their presence or absence

For each feature, we identified both the primary classification (Category 1) and secondary classification (Category 2) based on the highest and second-highest response percentages.

| Feature | Category 1 | Category 2 | Must-have | Performance | Attractive | Indifferent | Reverse | Questionable |

|---|---|---|---|---|---|---|---|---|

| Sufficient calories | Reverse | Attractive | 11% | 14% | 18% | 17% | 21% | 18% |

| High-protein content | Performance | Questionable | 14% | 29% | 18% | 5% | 5% | 29% |

| Balanced macronutrients | Questionable | N/A | 18% | 13% | 21% | 8% | 9% | 31% |

| 100% vegan | Indifferent | Attractive | 2% | 4% | 25% | 31% | 15% | 23% |

| Essential micronutrients | Must-have | Questionable | 25% | 17% | 20% | 8% | 8% | 23% |

| Free from artificial ingredients | Attractive | Questionable | 10% | 22% | 25% | 12% | 6% | 24% |

| Third-party verification | Attractive | Indifferent | 8% | 9% | 27% | 25% | 7% | 24% |

| Allergen-free | Indifferent | N/A | 6% | 8% | 18% | 43% | 8% | 17% |

| Smooth texture | Questionable | N/A | 15% | 16% | 19% | 10% | 7% | 34% |

| Natural taste | Questionable | Attractive | 8% | 18% | 25% | 12% | 6% | 31% |

| Flavour variety | Attractive | Questionable | 10% | 15% | 30% | 11% | 5% | 29% |

| Easy storage | Attractive | Must-have | 22% | 10% | 23% | 20% | 6% | 20% |

| Sustainable packaging | Indifferent | Attractive | 5% | 8% | 29% | 36% | 6% | 15% |

Attractive features which offer opportunities for differentiation

Eight product features emerged as attractive in either the primary or secondary classification. These represent opportunities to create positive surprises, as consumers don’t necessarily expect these features but genuinely appreciate them when present.

Easy storage received ratings of 23% attractive and 22% must-have, revealing divergent consumer expectations about whether this feature should be standard across all products.

Third-party verification, Free from artificial ingredients, and Flavour variety were all also found to be attractive, indicating that they delight consumers when present.

Four features were primarily categorised into Indifferent, Reverse, or Questionable while having attractive as their second category:

- Sustainable packaging (36% indifferent, 29% attractive)

- 100% vegan formulation (31% indifferent, 25% attractive)

- Natural taste (31% questionable, 25% attractive)

- Sufficient calories (21% reverse, 18% attractive)

These findings suggest divided opinions on the attractiveness of these features, indicating they may appeal to specific consumer segments rather than serving as universal selling points.

Performance features that directly drive satisfaction

Only one product attribute was primarily classified as a performance feature: High-protein content (29%% of respondents), indicating many consumers actively evaluate protein levels when selecting meal replacements. However, an equal percentage (29%) categorised it as questionable, potentially revealing a distinctly polarised consumer perception about protein content’s importance.

This pronounced split suggests protein content serves as a key satisfaction driver for a significant consumer segment, while creating uncertainty for others. Brands should therefore implement targeted communication strategies about protein benefits to address potential confusion and convert the questioning segment into performance-oriented consumers.

Features with limited impact

Three features were categorised as indifferent to respondents, being:

- Allergen-free formulation (43% indifferent)

- Sustainable packaging (36% indifferent, 29% attractive)

- 100% vegan formulation (31% attractive, 25% indifferent)

While these features may not drive overall satisfaction, brands could consider further research into specific consumer segments where these attributes may create differentiation, such as allergy sufferers, environmentally conscious shoppers, and the vegan community.

The rarity of must-have features

Only one feature emerged as a must-have: Essential micronutrients received the highest must-have rating at 25%, with questionable (23%) as a close secondary. This split suggests consumers are divided on whether complete vitamin and mineral content is essential or simplt confusing.

This relative absence of clear must-have features presents both opportunities and challenges for brands, as there are fewer mandatory features to implement, but also less clarity on what makes a minimally acceptable product. Future research may benefit from reconsidering which features to include in Kano surveys to better identify emerging must-have attributes as this category develops.

Potential areas of uncertainty or confusion

Notably, the analysis also revealed higher questionable ratings across multiple attributes than typically seen in Kano model studies. These elevated questionable ratings often indicate consumer confusion about what these attributes mean specifically for meal replacement products or potential inconsistent implementation across brands. This pattern suggests an opportunity for brands to improve communication clarity about product features and their benefits.

Conclusions and recommendations

The research revealed that the meal replacement drink market remains evolving, as consumers are still forming opinions about which brands and product features truly matter to them. Here are several key insights that brands in the meal replacement market can leverage:

- Clear age-based patterns in consumption frequency suggest brands should consider targeted formulations and marketing approaches for different age demographics.

- A large recognition-to-usage gap exists among brands indicating potential to outperform existing competition through better product-market fit.

- Easy storage may serve as an opportunity for brands to positively surprise consumers and build loyalty.

- High-protein content emerged as a key performance feature, suggesting that brands should prominently communicate their protein levels and consider how to optimise this attribute.

- The lack of clear must-have features and high questionable ratings across multiple attributes suggest consumers are uncertain about what constitutes essential product characteristics, presenting an opportunity for brands to educate the market through clearer communication.

Through addressing these insights, meal replacement product brands can position themselves for greater success in this evolving market.

Discover what your consumers truly value with your own Kano model experiment today, or schedule a consultation to discuss how Kano can uncover your product opportunities.