Brand Tracker by Conjointly is an automated, enterprise-grade brand tracking solution that delivers sophisticated brand health and competitive metrics without the legacy overhead.

Do you know which brands in your category command the highest trust, or which competitors convert awareness into preference most efficiently?

Brand tracking answers these questions by measuring how consumer attitudes shift over time. However, many traditional solutions became six-figure commitments that deliver static reports months after insights were irrelevant.

Brand Tracker by Conjointly changes this model with automated, enterprise-grade tracking at a fraction of traditional costs. No bloat, no hidden costs, no multi-month delays.

What is brand tracking?

Brand tracking studies survey consumers with the same questions at chosen intervals and typically includes:

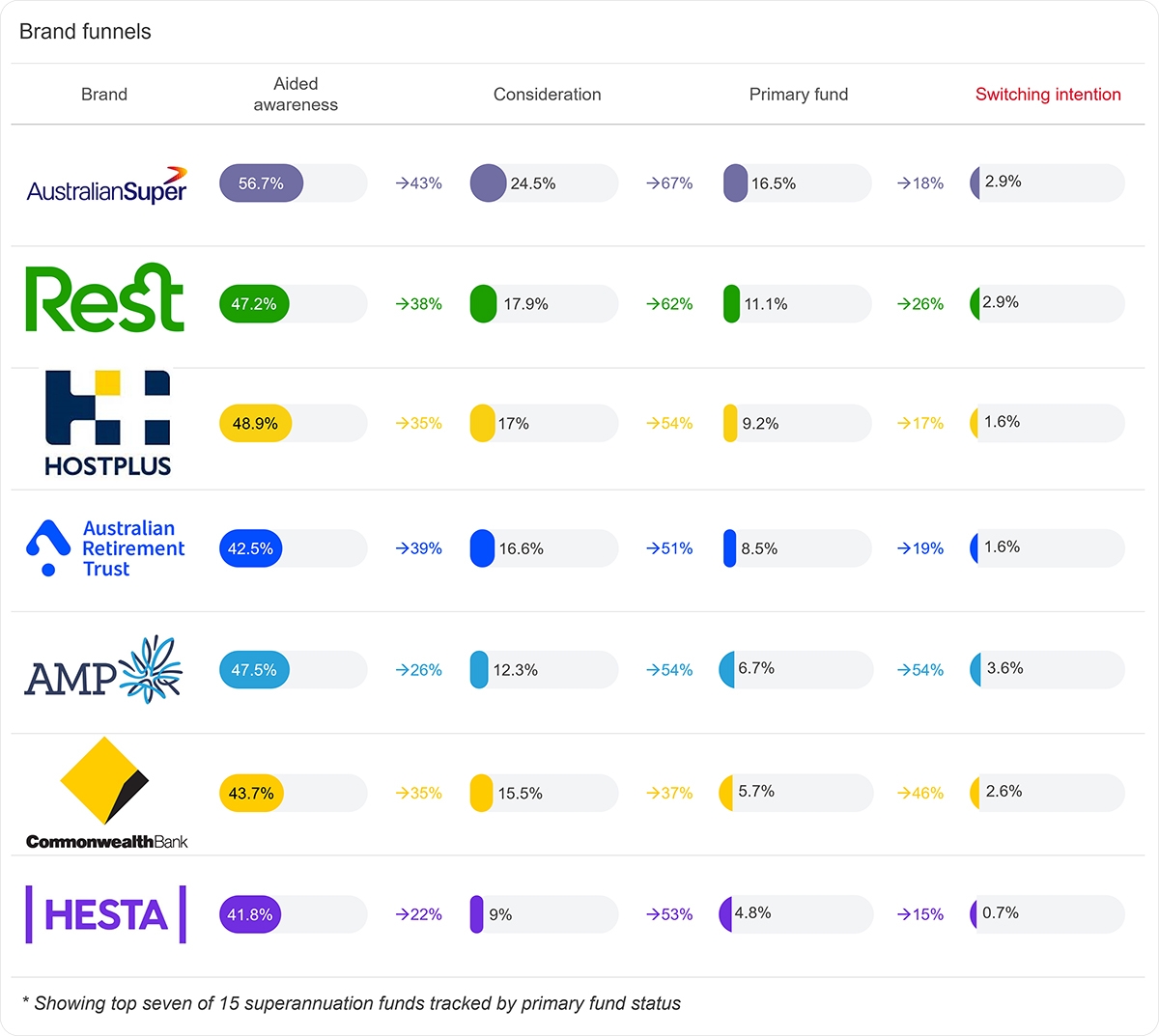

- Brand funnel analysis, which tracks consumers through awareness, consideration, purchase, and preference stages to reveal where conversion strengthens or weakens

- Category diagnostics, which measure quality perceptions, trust, value, and competitive positioning across competitors

The value of brand tracking compounds over time as it reveals whether consumer behaviour is genuinely shifting or stabilising, if strategic decisions are moving perception in the intended direction, and what hidden patterns are emerging.

See an example of why tracking studies matter

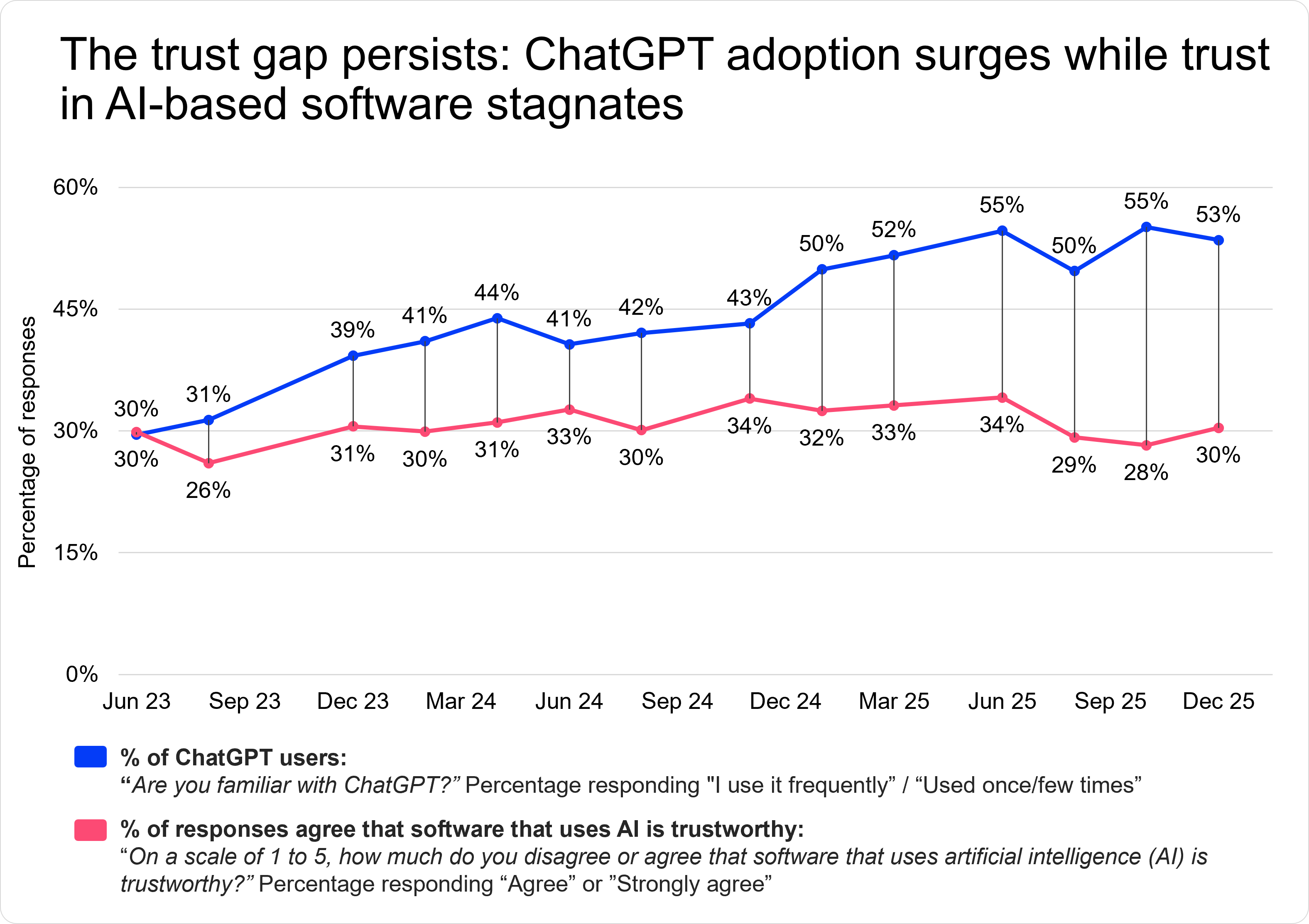

Brands would typically assume rising adoption means declining concerns. However, Conjointly's AI Adoption and Opinion Tracker reveals a different pattern.

Over 14 research waves between June 2023 and December 2025, Americans increasingly integrated AI into their lives, yet their concerns and desire to halt its development remained consistently high.

For AI brands, this suggests consumers adopt out of necessity, not trust, and the adoption may not sustain unless brands start to address concerns actively.

Read the full tracker findings to see how continuous measurement reveals patterns in consumer preference and sentiment over time.

Introducing Brand Tracker by Conjointly

Despite the value of brand tracking, many brands skip it because traditional services demand six-figure budgets and multi-month timelines for reports that arrive after insights become irrelevant.

Brand Tracker changes this model by publishing syndicated data, a proven approach designed to measure brand funnel metrics and category-specific trends using consistent methodology.

This model brings various advantages, including:

- Fast research setup and reporting. Start tracking within days and access results immediately after each wave, not months later.

- Rigorous insights with multi-layered quality controls.

- Affordable pricing thanks to multiple brands share research costs within each category.

- Minimum time to insights as a dedicated professional research team analyses data and delivers insights immediately after each collection wave.

- Transparent offering with options to scale. What you see is what you pay and what you get. No surprise costs.

For monitoring of your own brand with advanced analytics and real-time dashboards, Priority Access starts at USD 4,000 annually, a fraction of industry-standard costs. Custom tracking solutions tailored to your specific requirements are also available.

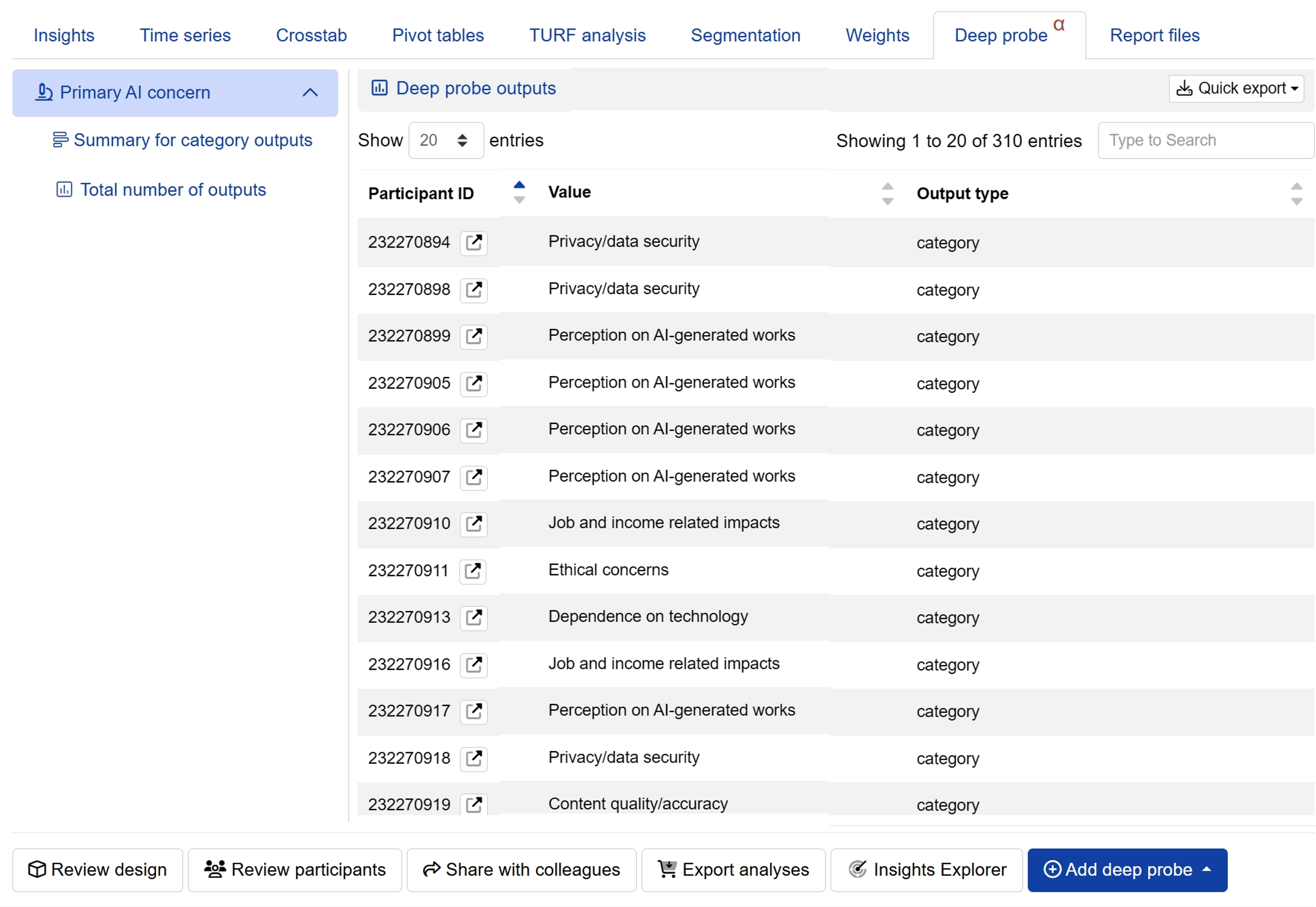

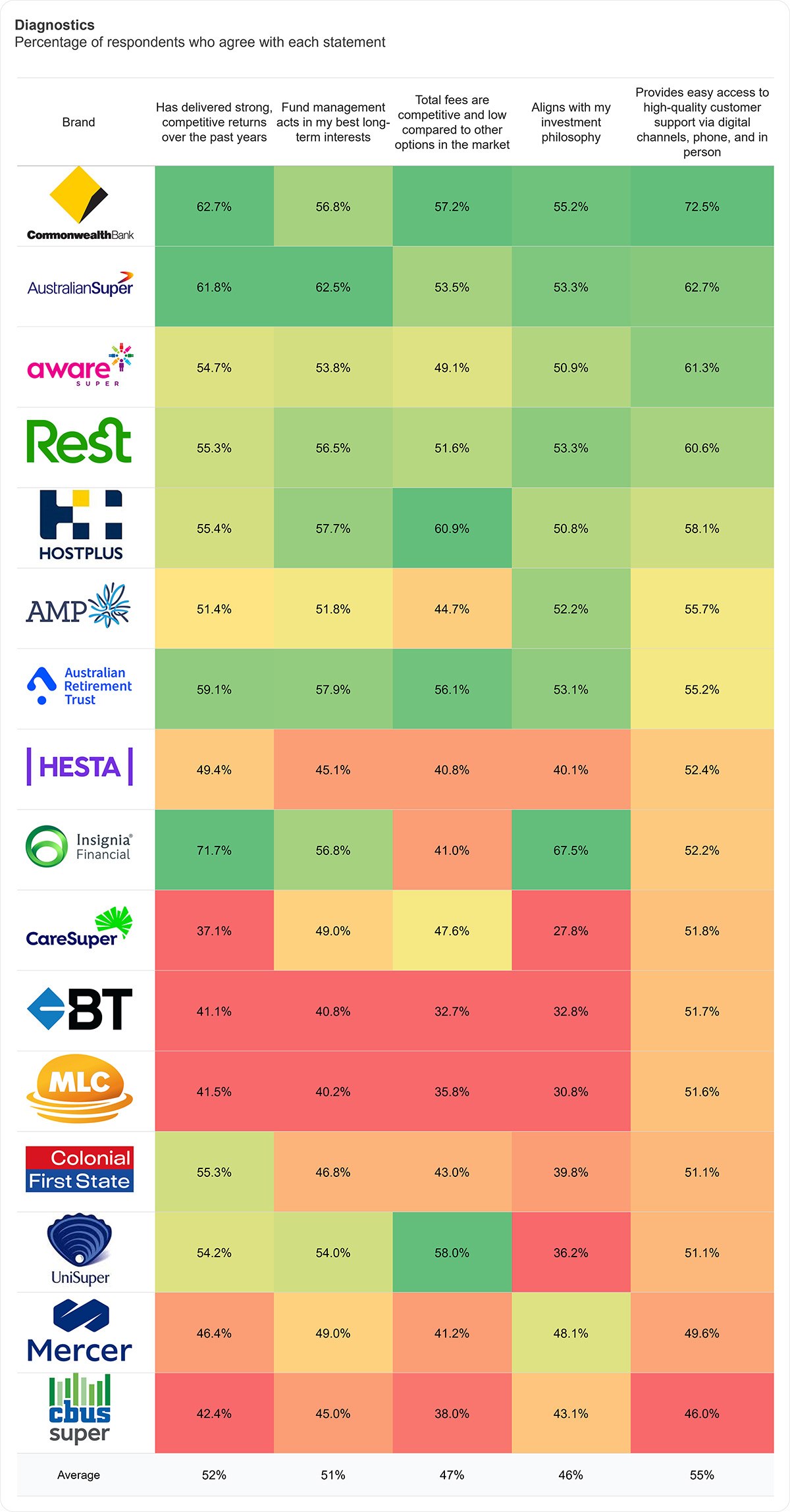

See Brand Tracker in action

Brand Tracker publishes dashboards that display brand funnels and diagnostics for every tracked competitor.

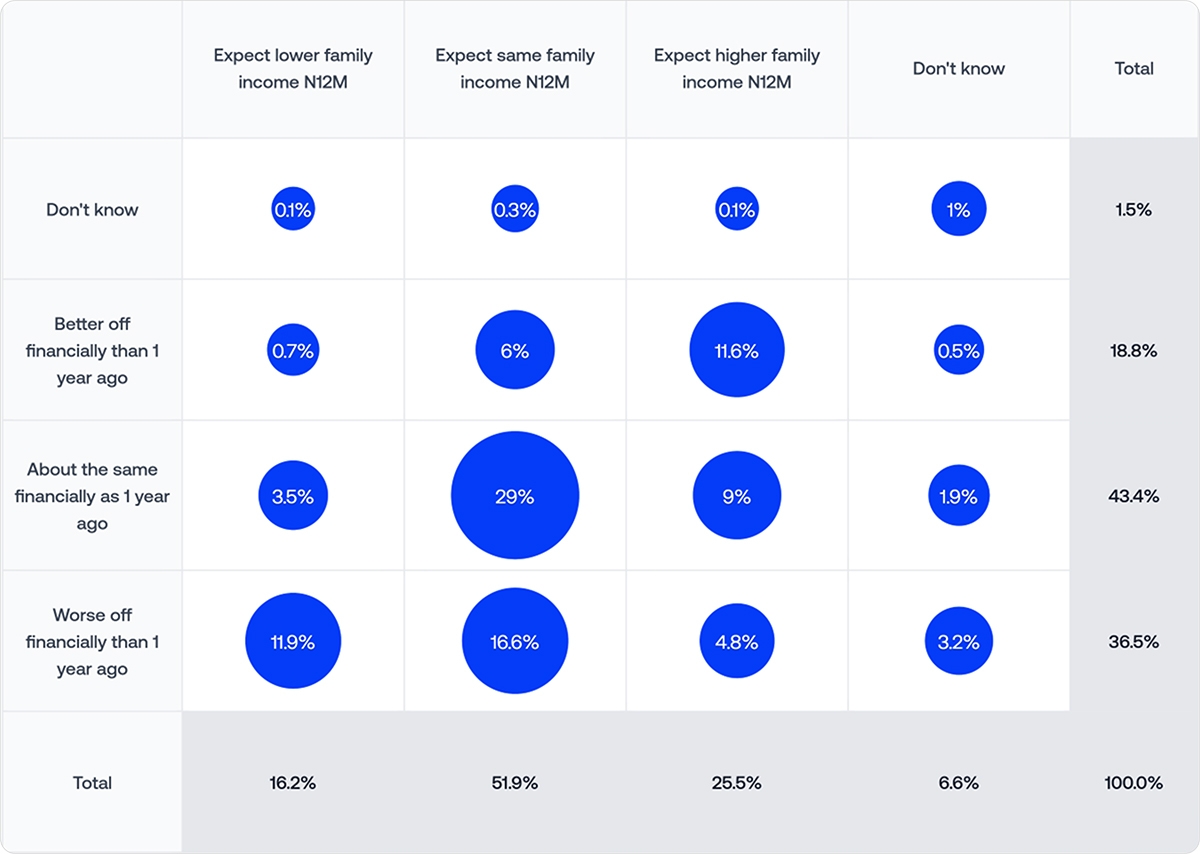

Explore the first wave of data for Australian economic indicators and four industries: ice cream, superannuation, mortgages, and dog food. See how consumer sentiment is shifting and how Australians rate and choose brands.

Tell us what you need tracked

Conjointly is expanding Brand Tracker based on what insights you actually need. Get in touch to tell us what matters for your business or your desired brand tracker.

Explore the Brand Tracker yourself to see exactly what you're getting. You are also encouraged to subscribe to Brand Tracker updates to get notified when new waves, new industries or new markets launch.