Conjointly has launched Brand Tracker by Conjointly, a brand tracking solution that sheds light on brand performance in the Australian ice cream market.

Sydney, 27 January 2026 – Conjointly has launched Brand Tracker by Conjointly, a brand tracking solution that sheds light on brand performance in the Australian ice cream, sorbet and gelato market.

The market at a glance

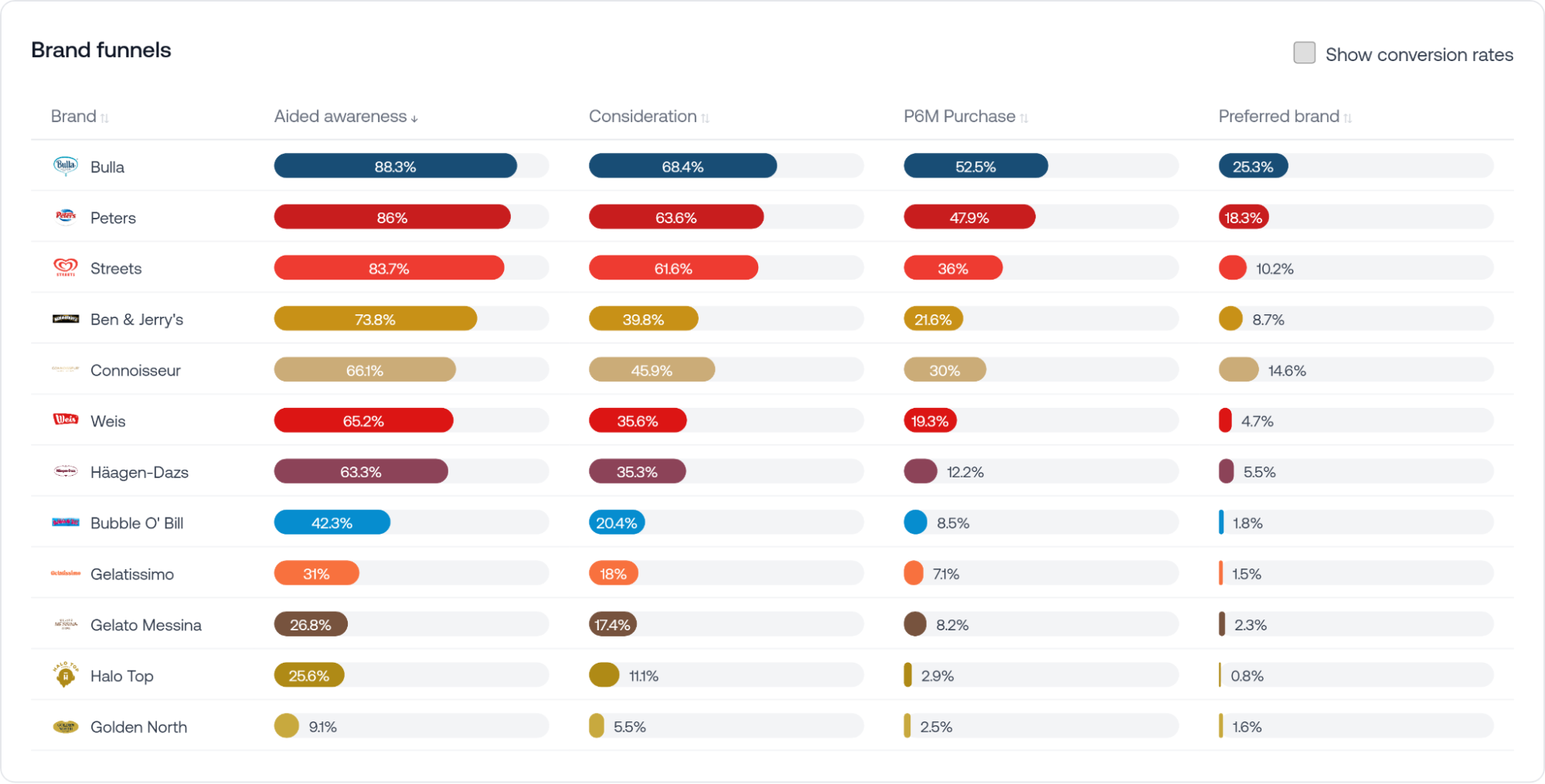

- Highest preference share: Bulla holds the lead across all funnel stages, recording 88.3% aided awareness and an impressive 25.3% preference share.

- Awareness vs Preference: While Peters and Streets have high recognition, as the second and third highest awareness brands, their preference sits considerably behind Bulla.

- High conversion efficiency: Connoisseur demonstrates the second highest conversion efficiency. While having lower awareness (66.1%) than a similar premium brand in Ben & Jerry’s (73.8%), it commands nearly double the preference share (14.6% vs 8.7%).

Initial Findings from Australian Ice Cream Market

Bulla leads across every funnel stage, with 88.3% awareness, 68.4% consideration, and 25.3% preference. Peters (86.0% awareness, 63.6% consideration, 18.3% preference) and Streets (83.7% awareness, 61.6% consideration, 10.2% preference) form a competitive second tier at awareness and consideration but fall substantially behind at preference.

A mid-tier grouping emerges with Connoisseur (66.1% awareness, 45.9% consideration, 14.6% preference), Ben & Jerry’s (73.8% awareness, 39.8% consideration, 8.7% preference), and Häagen-Dazs (63.3% awareness, 35.3% consideration, 5.5% preference) all achieving reasonable awareness, however, Ben & Jerry’s and Häagen-Dazs underperform in their preference relative to their awareness levels.

“The data from this initial wave highlights the relationship between brand awareness and consumer choice,” says Nik Samoylov, Founder of Conjointly. “While brands like Peters and Streets maintain a level of recognition comparable to Bulla, Bulla holds a considerable lead above in preference share about both. We also see that Connoisseur records nearly double the preference share of Ben & Jerry’s, despite having lower awareness. These findings suggest that for some brands, high awareness doesn’t necessarily translate into high preference share.”

Artisanal brands like Gelato Messina (26.8% awareness, 17.4% consideration, 2.3% preference) and Gelatissimo (31.0% awareness, 18.0% consideration, 1.5% preference) have cultivated a strong brand presence, with a high percentage of aware customers actively considering the brand. While the conversion to preference is currently low, this may be a reflection of limited distribution in major supermarkets. By expanding physical availability, there is a strong opportunity to capture preference amongst consumers who are already considering the brands.

The findings are based on a syndicated study of 1,344 Australian customers, with 962 respondents qualifying as past 6 months purchasers of packaged ice cream, sorbet, or gelato. Participants were recruited via Conjointly’s panel network and compensated for their time, with the sample weighted to national demographics to ensure findings are market-representative.

Explore the Australian ice cream, sorbet and gelato data at https://brandtracker.conjointly.com/australia/packaged-ice-cream-sorbet-or-gelato/.

About Brand Tracker by Conjointly

Brand Tracker delivers automated brand performance reporting with rigorous, market-representative insights. Australian businesses across industries can now access statistically weighted brand funnel data, including awareness, consideration, purchase intent and preference.

“We built Brand Tracker because traditional brand tracking locked businesses into expensive, inflexible contracts and delivered snapshots long after market conditions shifted,” said Nik Samoylov, Founder of Conjointly. “Brand Tracker gives Australian businesses the easy-to-use and easy-to-digest analytics they need to know their brand positioning, brand awareness and more, without requiring a six-figure commitment.”

Brand Tracker currently offers Australian businesses free access to detailed public brand data across four industries. For monitoring of your own brand with advanced analytics and real-time dashboards, Priority Access starts from the industry-breaking price of $6,000 per year – a fraction of traditional agency costs. Custom tracking solutions are also available for businesses with specific needs.

About Conjointly

Conjointly started as a simple online tool for conjoint analysis in 2016 and has since evolved into an industry-leading market research platform. Conjointly holds ISO 20252:2019 (Sampling), ISO 27001:2022, ISO 27701:2019, and SOC 2 Type II certifications, and is a member of the Insights Association and the British Healthcare Business Intelligence Association.

Conjointly’s tools address the most common pricing and product research problems and are supplemented with expert support and guidance from experienced researchers. With thousands of projects performed on the platform, Conjointly is the go-to research place for hundreds of clients.