Conjointly has launched Brand Tracker by Conjointly, a brand tracking solution that sheds light on brand performance in the Australian packaged dog food market.

Sydney, 22 January 2026 Conjointly has launched Brand Tracker by Conjointly, a brand tracking solution that sheds light on brand performance in the Australian packaged dog food market.

Initial Findings from Australian Packaged Dog Food Market

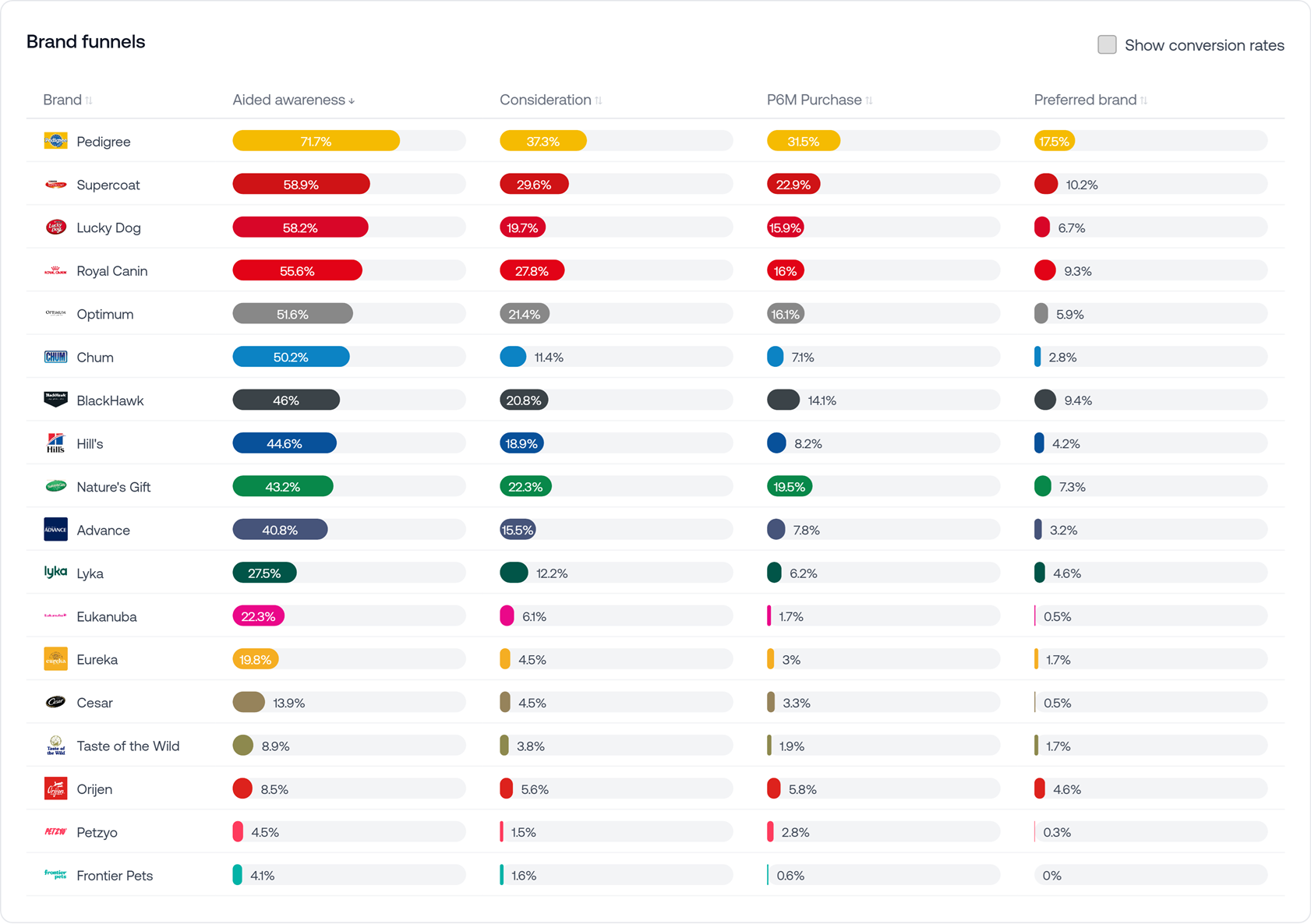

Pedigree has a towering presence in the Australian packaged dog food market. The brand achieves 72% awareness, 37% consideration, and 18% preference – substantially ahead of all competitors. No other brand captures more than 10% preference, making the gap between Pedigree and the second tier decisive.

A competitive second tier includes Supercoat (59% awareness, 30% consideration, 10% preference), Lucky Dog (58% awareness, 20% consideration, 7% preference), and Royal Canin (56% awareness, 28% consideration, 9% preference). These brands achieve substantial awareness but lag considerably behind Pedigree at both consideration and preference. Optimum (52% awareness, 21% consideration, 6% preference) and Chum (50% awareness, 11% consideration, 3% preference) show moderate awareness but significantly underperform at consideration. Hill’s presents a different problem: while its awareness of 45% is within reach of the mid-tier, it captures only 4% preference compared to Supercoat’s 10%, indicating a steeper drop-off in the funnel.

Nature’s Gift (43% awareness, 22% consideration, 7% preference) demonstrates solid conversion efficiency, capturing relatively strong consideration despite mid-tier awareness. Eukanuba presents a striking anomaly: 22% awareness but only 0.5% preference, indicating a pronounced awareness-to-preference gap suggesting failure to win choice among those aware of the brand. BlackHawk (46% awareness, 21% consideration, 9% preference) shows much stronger conversion efficiency, nearly matching Royal Canin’s preference levels despite lower initial awareness.

People in the industry are also watching closely the gap between mainstream supermarket brands and emerging premium players. Brands like Lyka (28% awareness), Eureka (20%), and Frontier Pets (4%) represent the growing fresh/freeze-dried segment challenging traditional kibble.

Explore the Australian packaged dog food data at https://brandtracker.conjointly.com/australia/packaged-dog-food/.

About Brand Tracker by Conjointly

Brand Tracker delivers automated brand performance reporting with rigorous, market-representative insights. Australian businesses across industries can now access statistically weighted brand funnel data, including awareness, consideration, purchase intent and preference.

“We built Brand Tracker because traditional brand tracking locked businesses into expensive, inflexible contracts and delivered snapshots long after market conditions shifted,” said Nik Samoylov, Founder of Conjointly. “Brand Tracker gives Australian businesses the easy-to-use and easy-to-digest analytics they need to know their brand positioning, brand awareness and more, without requiring a six-figure commitment.”

Brand Tracker currently offers Australian businesses free access to detailed public brand data across four industries. For monitoring of your own brand with advanced analytics and real-time dashboards, Priority Access starts from the industry-breaking price of $6,000 per year – a fraction of traditional agency costs. Custom tracking solutions are also available for businesses with specific needs.

About Conjointly

Conjointly started as a simple online tool for conjoint analysis in 2016 and has since evolved into an industry-leading market research platform. Conjointly holds ISO 20252:2019 (Sampling), ISO 27001:2022, ISO 27701:2019, and SOC 2 Type II certifications, and is a member of the Insights Association and the British Healthcare Business Intelligence Association.

Conjointly’s tools address the most common pricing and product research problems and are supplemented with expert support and guidance from experienced researchers. With thousands of projects performed on the platform, Conjointly is the go-to research place for hundreds of clients.