Conjointly compared conversational surveys and typical open-ended questions to demonstrate when each approach works best and how to implement them effectively, using fast food consumption as the research topic.

Conversational Survey

Engage your consumers with interactive chat surveys

Advances in artificial intelligence and natural language processing have introduced conversational surveys as an alternative approach to qualitative research. Instead of presenting fixed questions in sequence, these surveys use AI-powered chat interfaces to respond dynamically based on participant input and create an engaging experience that feels like everyday conversation rather than a formal survey.

To compare how respondents engage and share their inputs through different formats, Conjointly surveyed US consumers on fast food consumption using both approaches. This topic was chosen because it encompasses various factors including price considerations, convenience factors, health awareness, and subtle motivations that participants may express differently depending on the method of engagement.

Sample and methodology

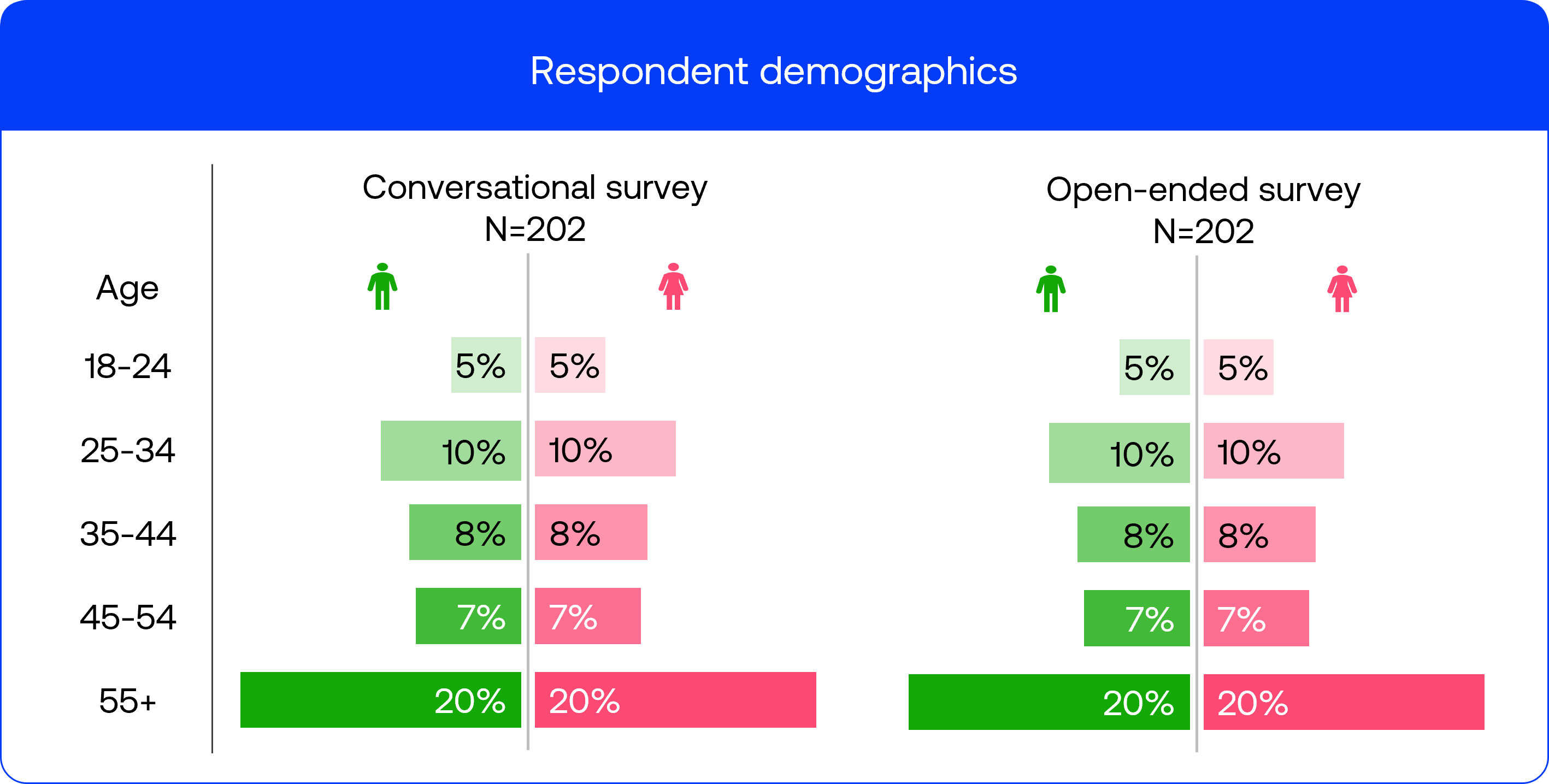

Conjointly sourced respondents for both surveys in April 2025 using Self-serve sample B, obtaining a nationally representative US sample of 202 respondents per survey.

Both surveys followed the same structure:

- Core questions on fast food consumption habits:

a. The open-ended survey followed a traditional format, presenting five fixed questions sequentially:Q1. How have changes in fast food prices over the past three months influenced your decisions about when, where, and how often to purchase fast food?Q2. What changes do you anticipate making to your fast food consumption habits in the next 6 months?Q3. What role, if any, do health considerations play in your fast food purchasing decisions?Q4. What role, if any, do environmental considerations play in your fast food purchasing decisions?Q5. Please describe what your typical fast food consumption looked like during a normal week in the past three months.b. For the conversational survey, we configured an AI interviewer to cover the same five core questions about fast food consumption, while maintaining a natural dialogue flow that allowed for relevant follow-up probing based on participant responses.

Below is the complete AI interviewer prompt we used for the conversational survey:

- Both surveys finished with the same four survey evaluation questions measuring participant satisfaction, perceived response completeness, effort required, and overall engagement.

Check out the example surveys to experience both approaches:

Comparing interview and response length

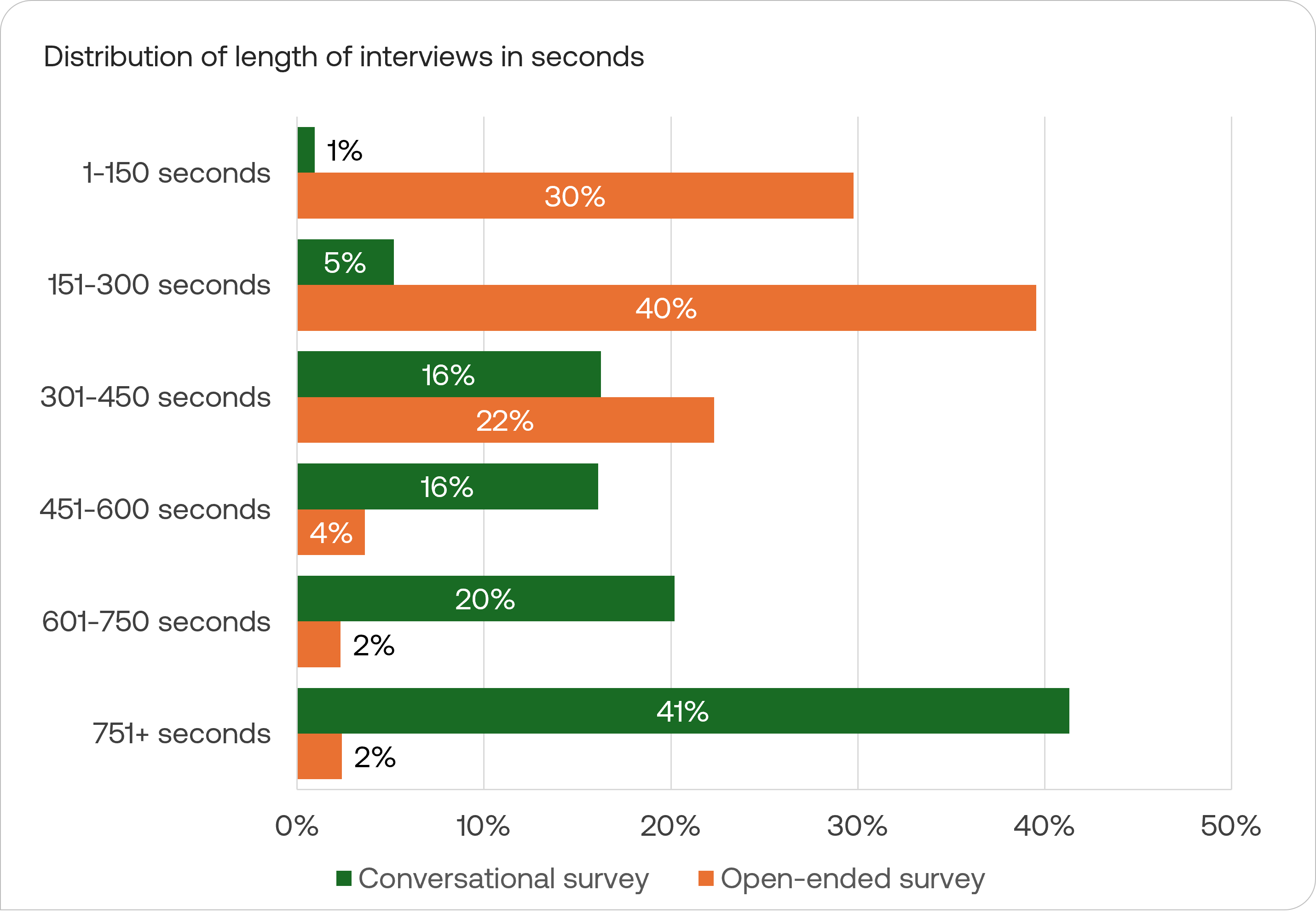

On average, respondents took more than twice as long to complete conversational surveys (816 seconds) compared to open-ended surveys (315 seconds). Notably, 61% of conversational survey respondents spent over 10 minutes, compared to only 4% of open-ended respondents. Meanwhile, 70% of open-ended survey respondents completed their surveys in under 5 minutes, compared to just 6% of conversational survey participants.

The longer interview duration of conversational surveys can be attributed to two factors. Firstly, the interactive dialogue format engaged respondents with 2-3 follow-up interactions per core question, expanding the typical experience from 5 core questions to an average of 14 questions per interview.

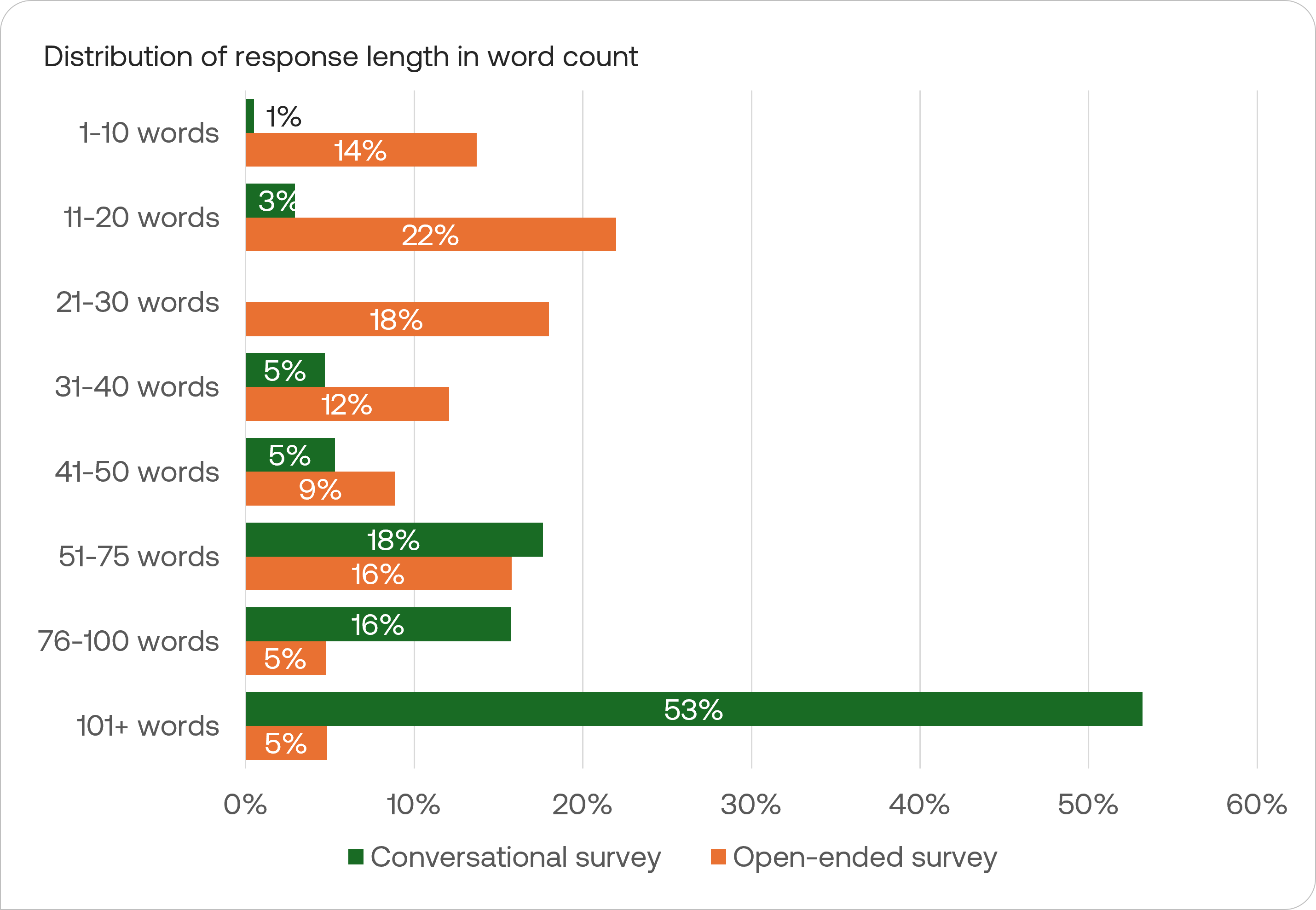

Secondly, participants typically provided more detailed responses when engaged in a conversational format. 53% of conversational survey responses contained more than 100 words, compared to just 5% in open-ended surveys. Open-ended surveys tend to produce shorter responses, with 54% of responses falling between 1-30 words.

Examining responses across survey types

AI summaries of responses

Conjointly offers automated AI summaries for all open-ended questions to help researchers quickly extract key themes without having to manually review thousands of individual responses.

For the conversational survey, summaries were automatically generated and organised around the most frequently asked questions, which in this case were the five core questions plus their related follow-ups.

Below are the AI-generated summaries for each question:

Based on the responses, here's a summary of the key themes:

- Reduced frequency: Many respondents report eating fast food less often due to price increases.

- Seeking value: There's an increased focus on finding deals, using coupons, and opting for value menu items.

- Shifting preferences: Some have changed where they eat, favoring cheaper establishments or those offering promotions.

- No change for some: A minority report that their fast food habits remain unaffected by price changes.

- Home cooking alternative: Several mention cooking at home more often as a cost-saving measure.

- Selective ordering: Some are more careful about what they order, often choosing cheaper options.

- Financial strain: Many express difficulty affording fast food as frequently as before.

- Varied impact: The degree of influence ranges from "not at all" to "dramatically changed" purchasing habits.

- Quality concerns: A few mention that quality, not just price, influences their decisions.

- Inflation awareness: Some respondents explicitly link fast food price increases to broader economic trends.

Changes in fast food prices over the past three months have led many respondents to reduce the frequency of their fast food purchases, with some opting to cook more at home or seek out value menu items and promotions. A few respondents mentioned that despite the price increases, their habits remained unchanged due to their strong preference for fast food. Overall, price increases have generally resulted in more cost-conscious behavior among consumers.

Based on the responses provided, here's a summary of the key themes regarding anticipated changes to fast food consumption habits in the next six months:

- Reduction in consumption: Many respondents plan to eat less fast food, citing reasons such as health concerns, rising prices, and budget constraints.

- No change: Some individuals anticipate maintaining their current habits, whether that means continuing to eat fast food regularly or abstaining entirely.

- Complete elimination: A subset of respondents intend to stop eating fast food altogether.

- Seeking better value: Some plan to look for deals, use coupons, or choose cheaper options to manage costs

- Cooking more at home: Many anticipate preparing more meals at home as an alternative to fast food.

- Healthier choices: A few respondents mention opting for healthier fast food options when they do eat out.

- Uncertainty: Some express uncertainty about their future habits, often tied to concerns about the economy or personal circumstances.

- Slight increase: A small minority anticipate a potential increase in their fast food consumption.

Overall, the dominant trend is towards reduced fast food consumption, primarily driven by financial considerations and health concerns.

Many respondents anticipate reducing their fast food consumption in the next six months due to rising prices and a desire to save money. Some plan to cook more meals at home, while others will continue to seek out value deals and promotions. A few mentioned that their habits would remain the same unless there are significant changes in prices or their personal circumstances.

Based on the responses provided, here's a summary of the main themes regarding health considerations in fast food purchasing decisions:

- No role or minimal consideration: Many respondents indicated that health plays little to no role in their fast food choices.

- Increasing awareness: Some people are becoming more conscious of the health impacts and are trying to reduce their fast food consumption.

- Specific health concerns: Several respondents mentioned conditions like diabetes, high blood pressure, or weight management that influence their choices.

- Moderation: Some individuals believe occasional fast food consumption is acceptable as part of a balanced diet.

- Healthier options: A number of respondents try to choose healthier menu items when eating fast food.

- Convenience vs. health: Some acknowledge the unhealthy nature of fast food but prioritize convenience.

- Complete avoidance: A few respondents avoid fast food entirely due to health concerns.

- Cost considerations: Some mentioned that healthier options are often more expensive, affecting their choices.

- Mixed attitudes: While some are very health-conscious, others admit to prioritizing taste or cravings over health when it comes to fast food.

Overall, there's a wide spectrum of attitudes, ranging from complete disregard for health to very health-conscious decision-making when it comes to fast food purchases.

Health considerations play a significant role for some respondents, influencing them to choose healthier options like salads, grilled items, or low-carb alternatives. However, for others, health factors are not a primary concern, and their choices are driven more by taste, convenience, or price. Overall, the impact of health considerations on fast food purchasing decisions varies widely among individuals.

Based on the responses provided, here's a summary of the key themes regarding environmental considerations in fast food purchasing decisions:

- No consideration: A significant number of respondents indicated that environmental factors play no role or very little role in their fast food choices.

- Packaging concerns: Some respondents expressed worry about the excessive use of plastic and non-recyclable materials in fast food packaging.

- Preference for eco-friendly options: A few respondents mentioned favoring restaurants that use sustainable practices, recyclable materials, or eco-friendly packaging.

- Lack of information: Some respondents noted that they would like to make environmentally conscious choices but lack information about which fast food places are more environmentally friendly.

- Health prioritization: Several responses suggested that health considerations take precedence over environmental concerns when it comes to fast food choices.

- Minor role: A small number of respondents indicated that environmental considerations play a minor or moderate role in their decisions.

- Guilt or awareness: A few responses expressed guilt about not considering environmental factors or acknowledged that they should probably pay more attention to this aspect.

Overall, while there is some awareness and concern about environmental issues related to fast food, it appears that for the majority of respondents, environmental considerations play a limited role in their fast food purchasing decisions.

Environmental considerations generally play a minor role or no role at all in most respondents' fast food purchasing decisions. A few individuals mentioned concerns about packaging waste and a preference for recyclable materials, but these factors were not significant enough to heavily influence their choices. Overall, price, taste, and convenience were the primary drivers of fast food consumption.

Based on the responses, here's a summary of typical fast food consumption patterns:

- Frequency:

- Ranges from never to multiple times per week

- Most common: 1-3 times per week or 1-2 times per month

- Some report reducing consumption recently

- Popular items:

- Burgers, fries, and sodas

- Pizza

- Chicken sandwiches or nuggets

- Tacos and burritos

- Breakfast sandwiches

- Common chains mentioned:

- McDonald's

- Wendy's

- Burger King

- Taco Bell

- Chick-fil-A

- Reasons for consumption::

- Convenience on busy days

- Treats or rewards

- Affordability

- When away from home

- Ordering methods:

- Drive-thru

- Takeout/pickup

- Delivery services

- Attitudes:

- Some express guilt or desire to reduce consumption

- Others view it as a regular part of their diet

- A few mention seeking healthier options within fast food menus

- Meal occasions:

- Lunch and dinner most common

- Some mention breakfast

Over the past three months, typical fast food consumption varied among respondents, with some eating fast food 2-3 times a week, often opting for burgers, fried chicken, pizza, or sandwiches. Others reported significantly reducing their fast food intake due to price increases, with some only eating fast food once a week or less, and a few completely avoiding it in favor of home-cooked meals.

Although different summarisation prompts were used for each approach (individual question summaries for open-ended responses versus topic-based summaries for conversational data), the resulting themes remained consistent because they addressed the same core questions about fast food consumption habits.

While the high-level insights appear similar, the real differences emerge when examining the individual responses.

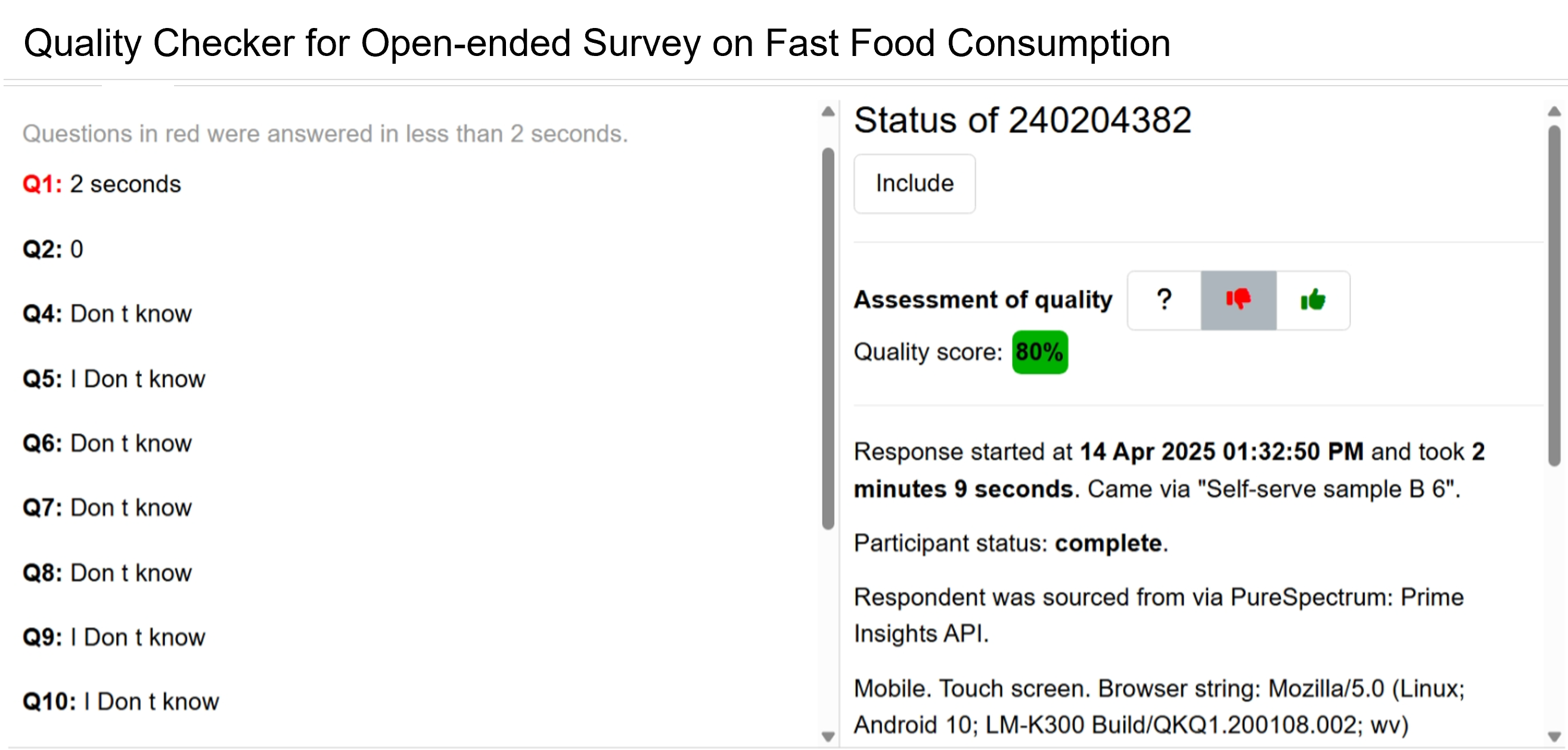

Low-effort responses

While automated checks can help exclude minimal-effort responses that provided little research value, open-ended surveys often require manual review during analysis. Consider this example of a respondent who answered “Don’t know” consecutively.

Conversational surveys can address this challenge through built-in validation mechanisms. When participants provided vague or shallow answers, the AI interviewer immediately requested clarification or offered alternative questions. When the pattern of minimal engagement continued even after prompting, the AI concluded the session earlier. Here’s an example of an interview transcript where a non-responsive participant was appropriately screened out:

Ambiguous responses

Another common scenario in qualitative research involves valid responses that lack sufficient context. For example, when asked about the impact of fast food price changes, responses like “No change” are legitimate but provide limited insight. Despite careful question design, there are few feasible options to formulate questions that completely eliminate such ambiguous responses.

Conversational surveys address this limitation through real-time clarification. For example:

This exchange reveals that the participant has observed price increases but remains unaffected due to preference towards quality options rather than value items. This allowed researchers to gain contextual understanding of the initial response without requiring additional research rounds or follow-up studies.

Detailed responses

Both open-ended and conversational survey formats can generate rich, detailed responses, though they achieve this through different mechanisms. Well-crafted open-ended questions with sufficient space for responses allow participants to thoroughly express their thoughts without interruption.

For example:

Q: How have changes in fast food prices over the past three months influenced your decisions about when, where, and how often to purchase fast food?

A: I don't eat at fast food places that much. Most of them serve unhealthy items such as burgers, French fries, and fried chicken. And besides, I am in a nursing facility undergoing medical treatment and therapy for an arthritic left leg. Under both Pennsylvania and Federal laws, nursing home residents can only have $60 a month for personal expenses. Plus, I also have issues with my Personal Needs Account at this time as well. Therefore, I have had to cut back on expenses at this time.

Conversational surveys create a comfortable environment that encourages detailed sharing through supportive follow-up questions and acknowledgment of responses. For example:

Unexpected perspectives

Qualitative research is particularly valuable when participants share inputs and ideas that might not surface in structured formats.

For instance, some responses went beyond typical health considerations and provided insights into specific tools and strategies consumers used to balance their health considerations and fast food consumptions.

Q: What role, if any, do health considerations play in your fast food purchasing decisions?

A: When ordering fast food I check my Weight Watchers app to check points. I try to order the healthiest foods such as salads and grilled chicken.

Similarly, the following conversational survey response revealed how the respondent’s health priorities lead them to prefer smaller portions, running counter to the value-oriented “more is better” marketing strategy prevalent in fast food.

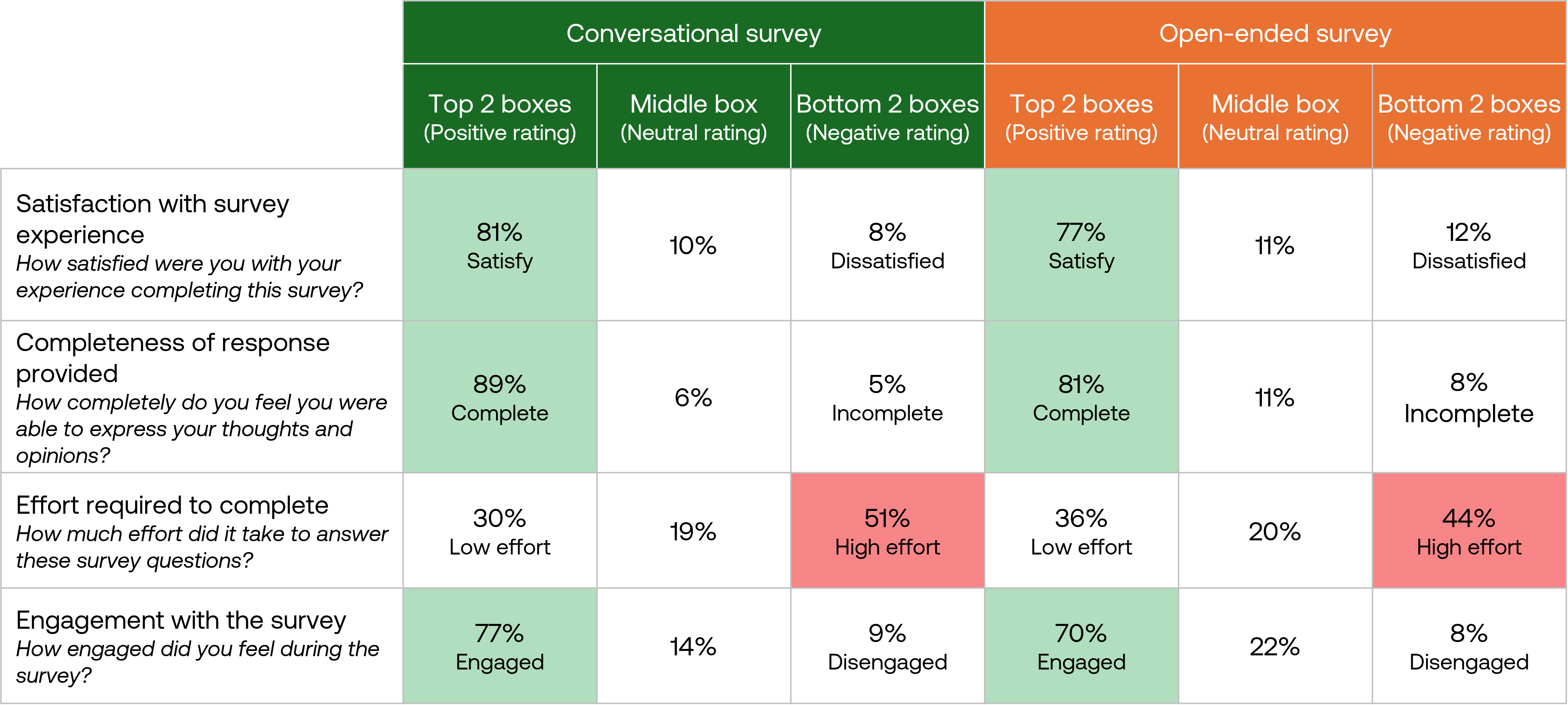

Analysing survey experience

Following the completion of each survey, respondents evaluated their experience across four key dimensions. The conversational survey format demonstrated slightly higher ratings overall compared to the open-ended approach:

Conversational survey respondents reported similar satisfaction levels to those participated in open-ended surveys (81% versus 77%) and were slightly more engaged with the survey (77% versus 70%). They were also slightly more likely to feel they provided comprehensive responses (89% versus 81%).

On the downside, slightly more conversational survey participants reported high effort (51% versus 44% for open-ended surveys).

Conclusions and recommendations

Open-ended survey questions are easy to be incorporated in any research, allowing participants to respond at their own pace and in their own words without feeling guided toward particular responses. This format can reduce certain types of interviewer bias that might emerge in conversational contexts, even with AI interviewers.

Conversational surveys, meanwhile, mimic natural human conversation patterns, creating an environment where respondents feel more comfortable elaborating on their thoughts, while offering opportunities for clarification and deeper exploration of emerging themes through adaptive follow-up questions.

Conjointly recommends:

- Consider open-ended questions when:

- Collecting thoughts or responses on well-defined topics.

- Working with tight research budgets or compressed timelines.

- Integrating qualitative elements within primarily quantitative surveys.

- Gathering straightforward responses from large sample sizes.

- Choose conversational surveys when:

- Conducting exploratory research requiring rich, contextual understanding.

- Researching complex topics where respondents require clarifications and additional context.

- Addressing sensitive questions where respondents may need encouragement to share their authentic perspectives.

- Working with target audiences who prefer interactive format or might have difficulty articulating nuanced opinions in a single response.

Regardless which approach you choose on the Conjointly platform, Deep probe automatically analyses your survey data using LLM analysis or custom formulas, saving you days of manual analysis work. Simply describe what you want to learn about your respondents and receive structured outputs in minutes rather than days.

Getting started

The effectiveness of conversational surveys primarily depends on well-designed AI prompts that take into consideration factors such as scope, main research questions, optimal follow-up questioning, appropriate conversation pacing, and more. Conjointly’s research team are ready to work with you to develop interview frameworks tailored to your specific research questions, ensuring you get the most out of methodologically sound data collection.

Schedule a consultation to learn more about how conversational surveys can enhance your next research project.