The first wave of Brand Tracker data is live, revealing interesting insights across Australian industries and economic indicators.

Did you know:

- REST ranks second among what Aussies consider to be their primary superannuation fund, but one in four customers intends to switch.

- Bulla leads Australia’s ice cream market while Connoisseur achieves strongest conversion among premium brands.

- Macquarie Bank ranks third for preferred mortgage providers, outperforming two Big 4 banks.

- 37% of Australians report being worse off financially than a year ago, yet most (52%) expect same family income over the next 12 months.

These aren’t random stats. They’re live competitive insights from real Australian markets, tracked alongside broader economic indicators.

All of this data is available now at Brand Tracker by Conjointly for free. You can also subscribe to Brand Tracker updates to get notified when new data waves go live.

Why Conjointly built Brand Tracker?

Conjointly built Brand Tracker because traditional brand tracking locked businesses into expensive, inflexible contracts and delivered snapshots long after market conditions shifted.

Brand Tracker by Conjointly is an automated, enterprise-grade tracking solution that delivers sophisticated brand health and competitive metrics through a syndicated model. Multiple brands share research costs within each category, so you access rigorous, standardised insights at a fraction of the traditional cost.

What you get

You can explore published dashboards at no cost to see how the platform works. If you want to track your own brand, Priority Access gives you private diagnostics, sophisticated analytics, and competitive positioning from AUD 6,000 annually. Custom solutions tailored to your specific requirements are also available. Get in touch to discuss what best suits your scale and needs.What we’ve found so far

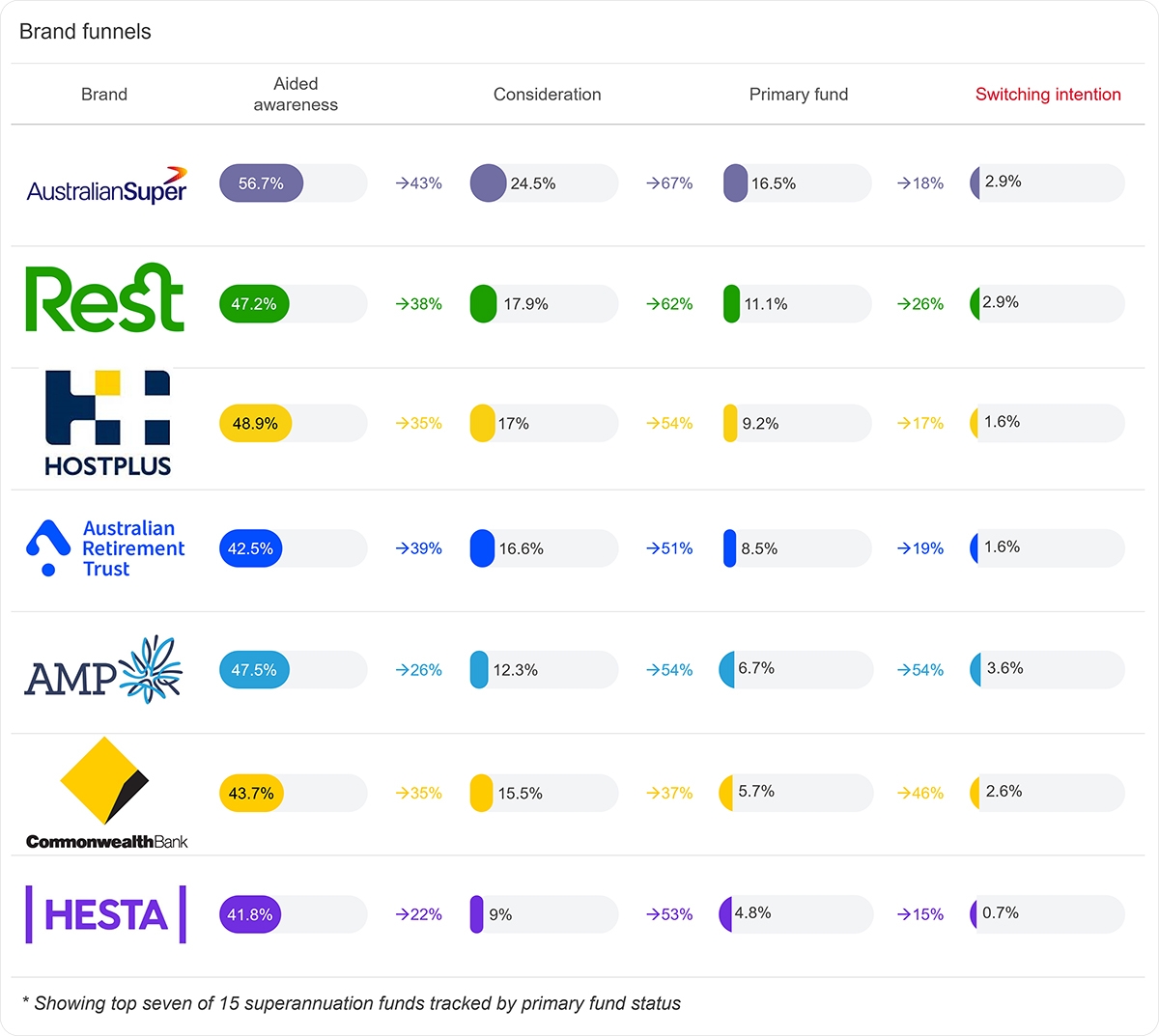

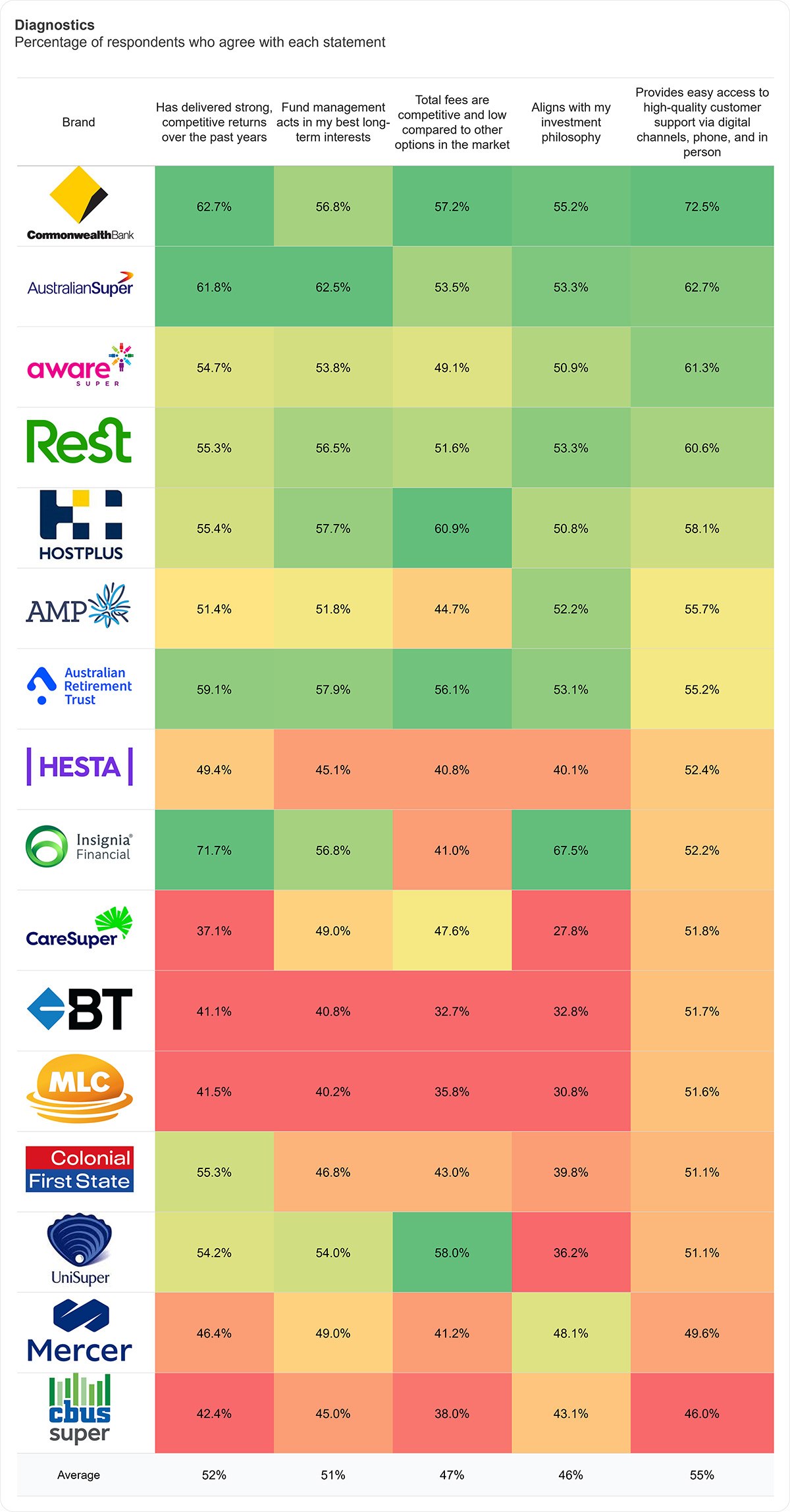

Superannuation fund: Even category leaders can't afford complacency

AMP holds a 6.7% share of primary fund status but faces the highest switching risk in the category. At 3.6% switching intention, AMP shows a 54% leakage rate against its customer base, outpacing all major competitors.

Consumer perception data highlights different brand strengths across the sector. CommBank Super achieves consistently high scores across all diagnostics, despite its lower primary fund share. Interestingly, Insignia, despite having the lowest awareness in the study receives a high perception score for competitive returns among those familiar with the brand.

Importantly, this data differs slightly from what APRA reports:

- We asked respondents about their primary super fund, not whether they have an account.

- We measure perception, not actual behaviour.

Packaged ice cream: Premium punches above its weight

Bulla and Peters lead at every funnel stage, yet conversion efficiency tells a more nuanced story. Bulla leads the category at 29%, transforming nearly one in three aware consumers into preference.

Premium player Connoisseur punches above its weight, achieving 15% preference from just 66% awareness translates to 22% conversion efficiency, outperforming mainstream giants Peters (21%) and Streets (12%).

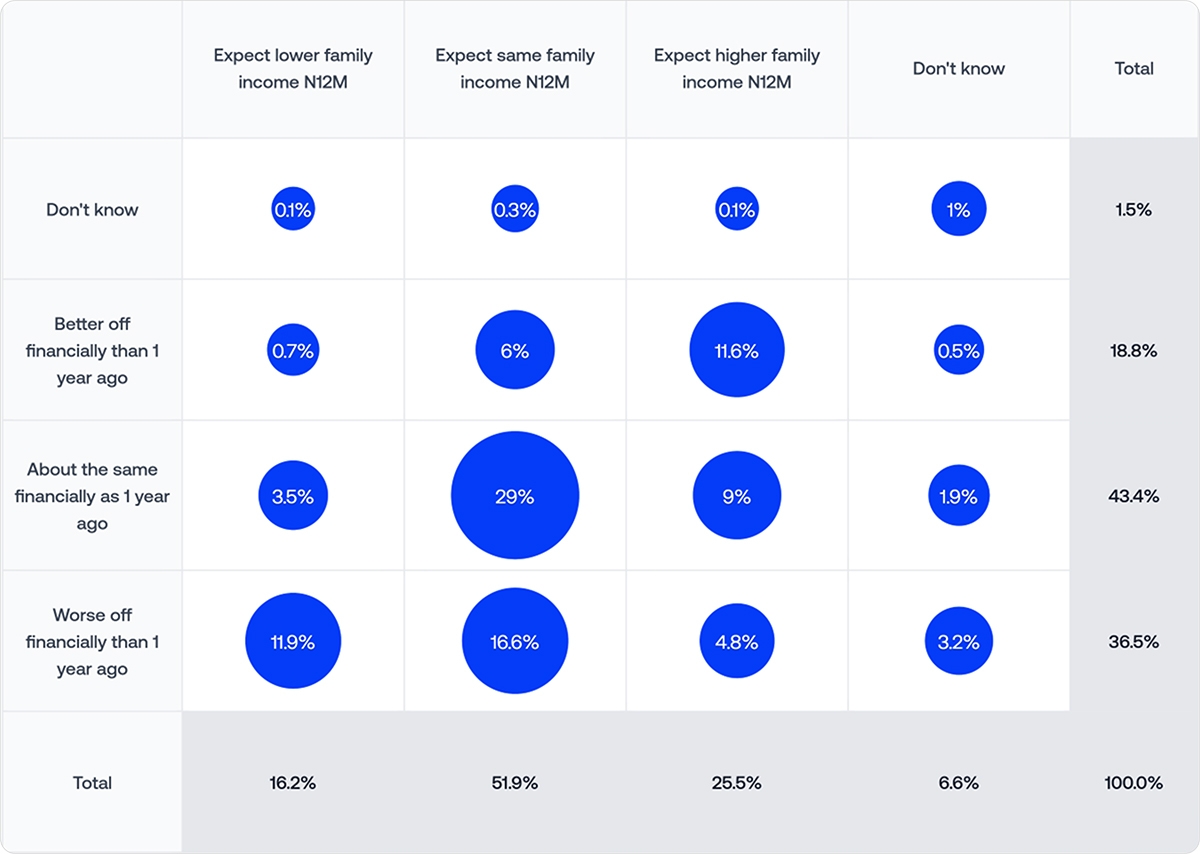

Economic indicators: Consumer confidence mixed as financial pressure persists

37% of Australians report being worse off financially than a year ago while 52% expect the same family income over the next 12 months.

Among those currently worse off, 12% expect lower family income ahead. Among those reported better off now, 12% expect higher income next year.

Financial pressure shifts brand choices differently across categories and price points. Tracking both sentiment and behaviour reveals how purchase decisions change as conditions evolve.

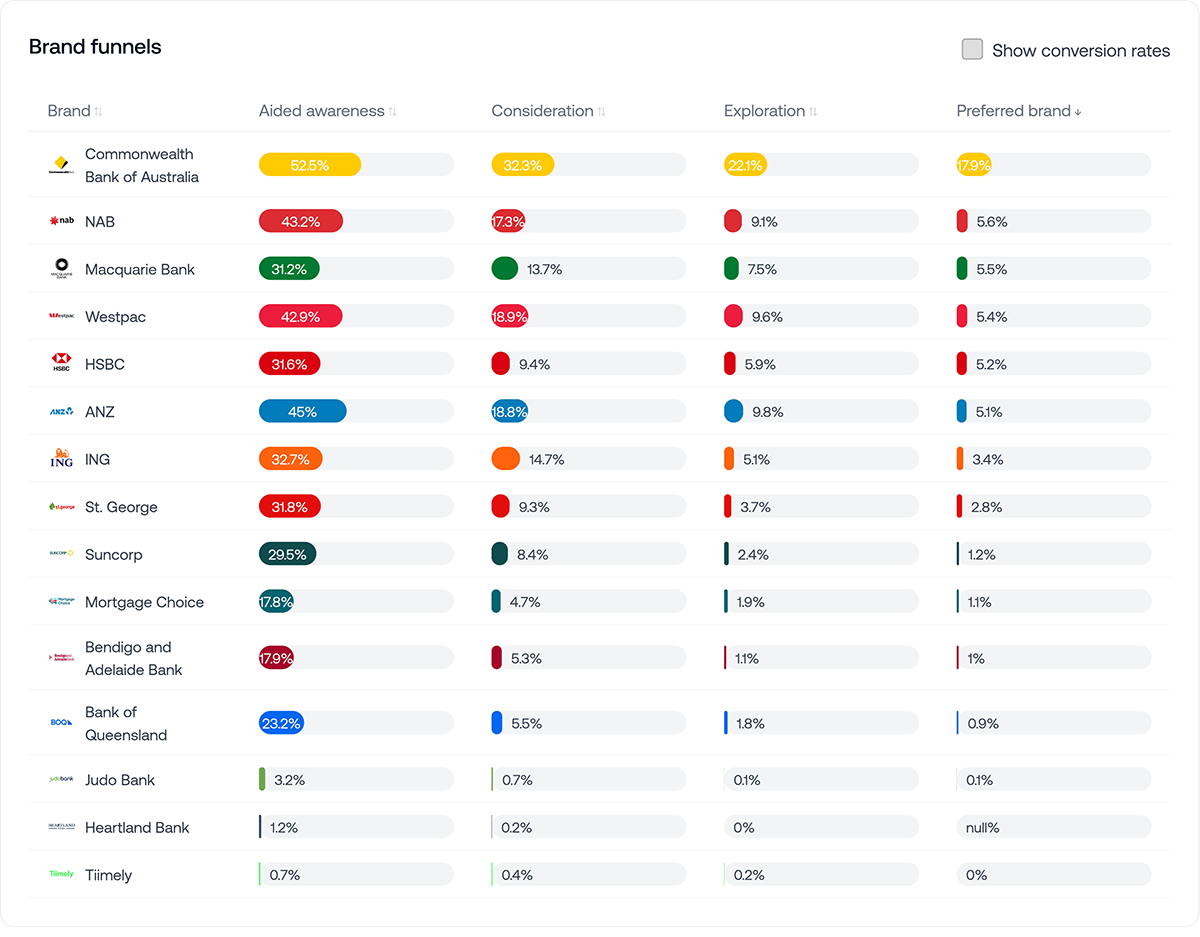

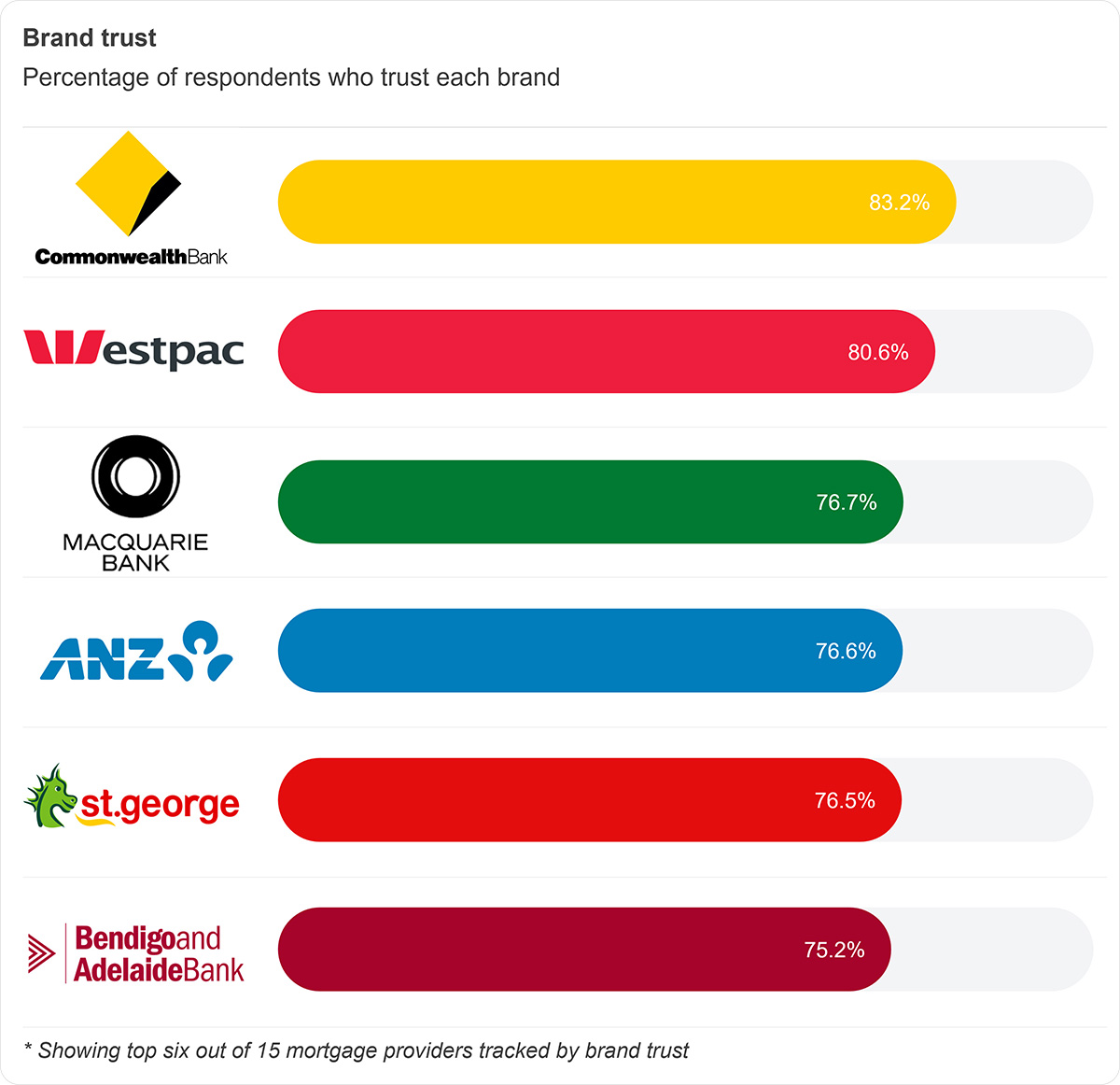

Mortgages: Challenger breaking into Big Four territory

Macquarie Bank captures 6% preference despite just 31% awareness, delivering conversion efficiency second only to Commonwealth Bank (CBA) in the category.

On trust, Macquarie sits at 77%, third overall, slightly ahead of ANZ and NAB. Strong credibility is driving conversion efficiency that rivals Big 4 banks.

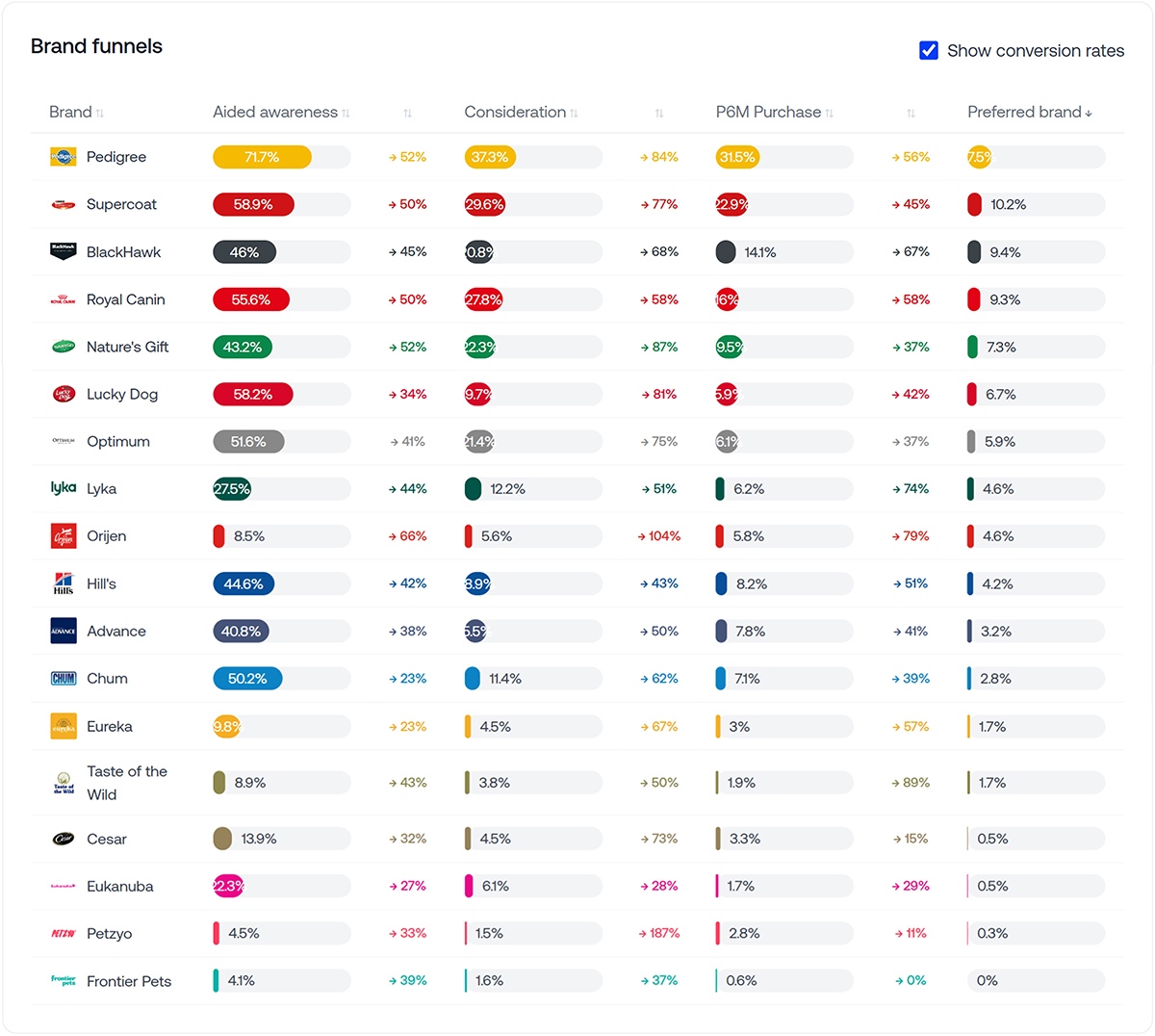

Packaged dog food: Efficiency beats fame in the aisle

Pedigree dominates packaged dog food awareness at 72% and preference at 18%, but challenger brands are punching above their weight.

BlackHawk converts 46% awareness into 9% preference, while Nature’s Gift turns 43% awareness into 7% preference. Both outperform established brands like Lucky Dog (58% awareness and 7% preference) and Chum (50% awareness and 3% preference).

The data suggests premium positioning compensates for lower awareness, allowing smaller brands to compete effectively in packaged dog food.

Ready to see how your brand stacks up?

See Brand Tracker in action across four Australian industries: ice cream, superannuation, mortgages, and dog food. Economic indicators are also available.

Want to track your own brand or discuss custom solutions? Get in touch to discuss what works best for your category and market.

You are also encouraged to subscribe to Brand Tracker updates to get notified when new waves, new industries, or new markets launch.